11 of the 26 economists surveyed by Reuters and Bloomberg expect a 50bp cut. We’re in that camp. And there are 15 economists calling for a 25bp move. The way we look at it… it’s exactly these sorts of odds that can give the RBNZ bang for buck. If they cut 50bp, it is not priced, it is not consensus, but it is needed. A 50bp move would get wholesale rates down, lowering retail rates. Whereas a 25bp cut would cause a lift in wholesale rates, making retail rates more sticky.

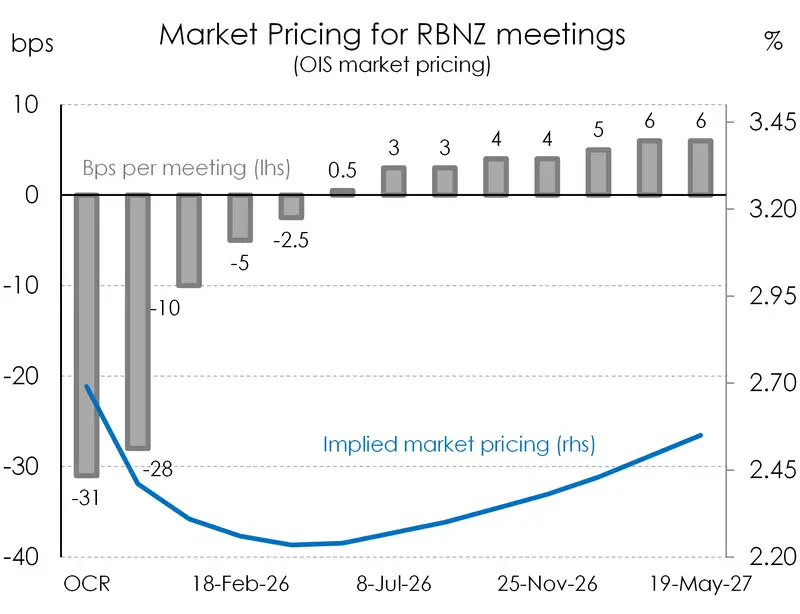

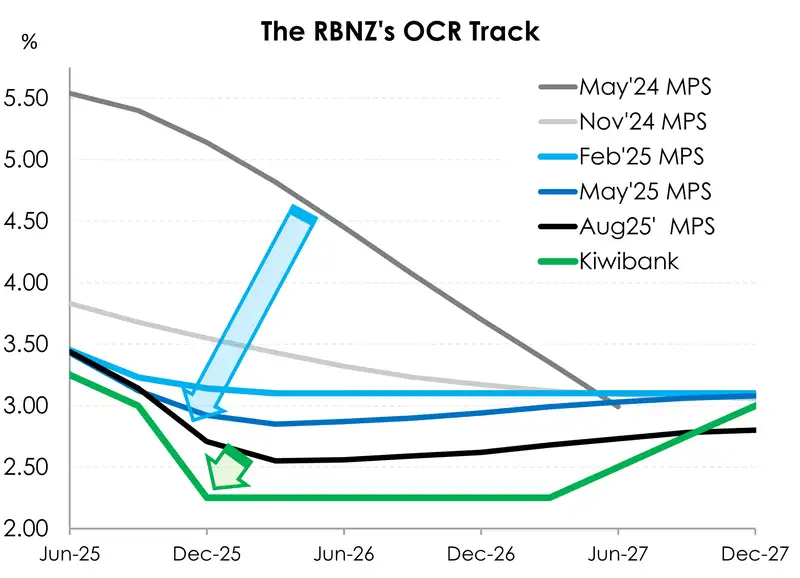

The market is reasonably priced, and reflects our core view (almost). Looking at the OIS strip, a 2.25% cash rate is priced by April/May. That’s close. But we think the RBNZ should get there by November. For this week’s decision, the market is divided between a 25bp cut and a 50bp cut. There is 31bps priced, to 2.69%. So a full 25bp cut is fully priced and there’s another 6bps thrown in towards a 50bp move. If they do cut by 50bps, the 2.69% rate drops 19bps to 2.5%, making waves. For November, the market has an implied rate of 2.41%. If the RBNZ do cut to 2.25%, then there is a hefty 16bps to fall. Pricing from February (2.3%) onwards is very close to our view.

The latest GDP report on the Kiwi economy’s performance shocked us into calling for, demanding, a 50bp cut this week. See: A deep economic contraction: The RBNZ is once again behind the eight ball. The economy needs stimulus.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.