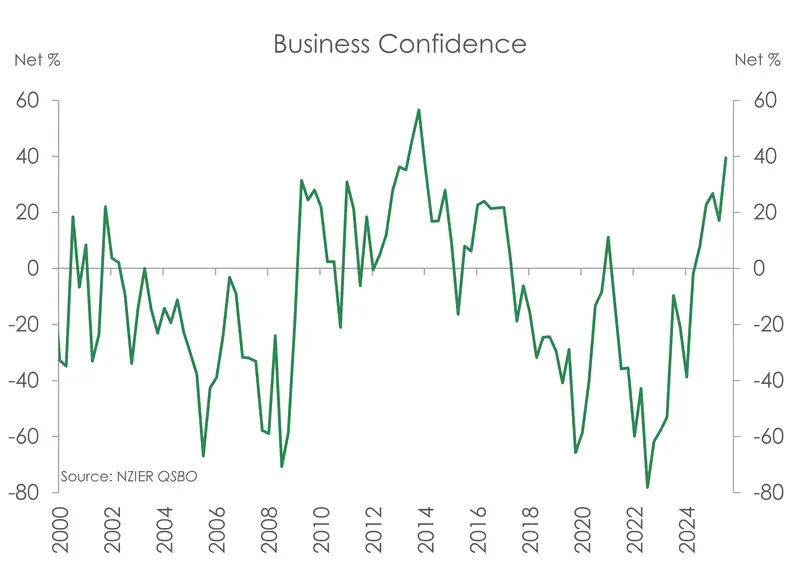

The mood is up! And the power of lower interest rates is clear. Business confidence in NZIER’s latest Quarterly Survey of Business opinion surged to its highest level since March 2014. A net 39% of firms expect an in improvement in general economic conditions, up from a net 17% previously. Even better, the lift in sentiment was broad-based across sectors and is reflective of a material improvement in experienced trading activity. Since the start of the RBNZ’s easing cycle back in August 2024, the share of firms reporting decreased trading activity has steadily declined. In the December quarter, just a net 3% of firms reported a drop in trading activity, down from a net 15% in the September quarter. Meanwhile, without seasonal adjustment, a net 4% of firms actually reported an increase in trading activity over the December quarter, breaking a two-year streak of declines and providing further evidence of a turnaround in demand.

As it turns out, a cash rate below neutral and into stimulatory settings was the simple medicine kiwi businesses and the economy needed. The RBNZ’s ‘circuit breaker’ 50bp rate cut to 2.50% back in October, followed by a further 25bps in November, clearly has taken effect. And not even the slight rise in retail interest rates seen at the end of last year has been able to temper the mood. Looking ahead, a net 23% of firms, the highest since early 2021, expect an increase in activity in the current quarter.

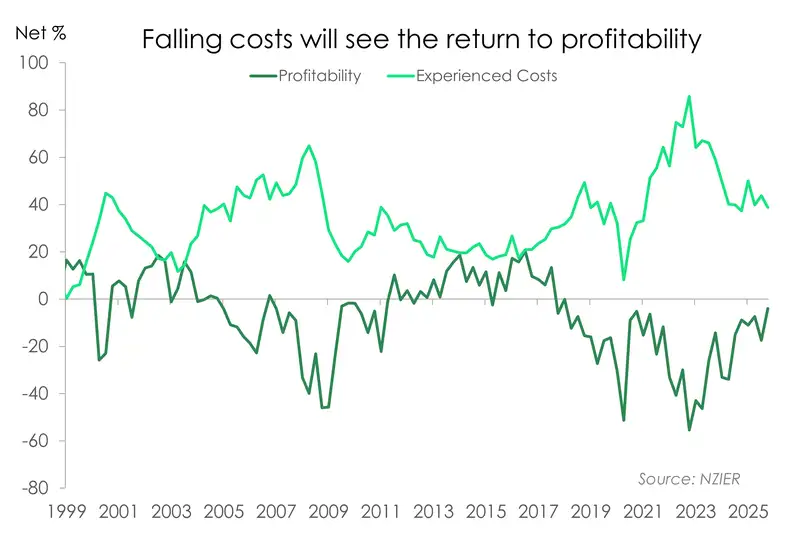

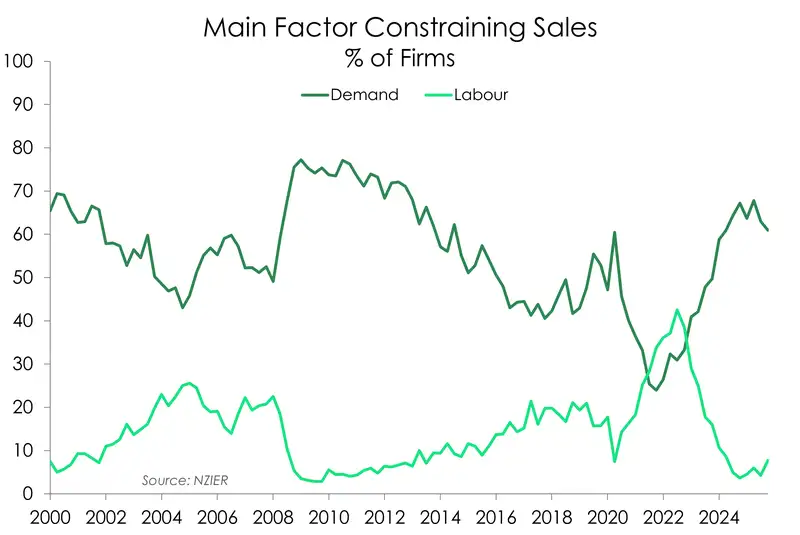

Combine recovering demand with easing costs and the outlook for businesses’ profitability has also improved. A net 25% of firms still reported declines in profitability, but that’s a smaller share than the net 37% last quarter, and one that should continue improving as the recovery builds momentum. Costs pressures have eased with the proportion of firms reporting higher costs now much closer to its long-term average. Meanwhile when it comes to pricing intentions, a net 25% of firms expect to lift prices in the current quarter, up from a net 7% previously. Though even so, the share of those expecting to lift prices remains below the long term average. With weak demand still cited as businesses’ main constraint, pricing power remains muted, reinforcing our view that inflation pressures remain contained. It is worth noting however that the ongoing outflow of Kiwis overseas and weaker migration is starting to be felt. Reports of difficulty finding skilled labour are beginning to emerge, most notably in the construction sector. It’s something we’ll likely see more of over the coming months as activity picks up and the appetite for labour improves further. A persistence in such a trend could add to increased price pressures further down the line. But for now it’s simply something to watch rather than worry about.

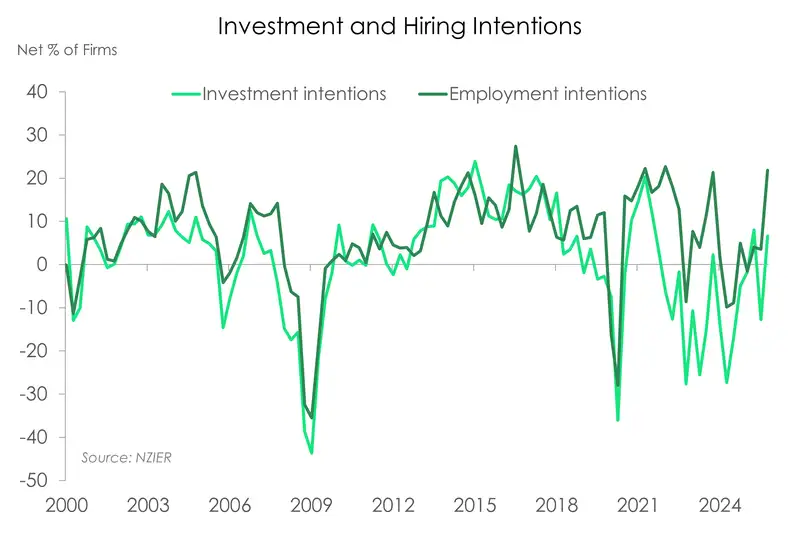

Put together, improved economic conditions and renewed confidence in a sustained recovery has given businesses enough certainty to recommence growth-oriented actions. A net 2% of firms expanded headcount over Q4, breaking a 7 quarter streak of net reported job cuts. And looking ahead, a net 15% of firms expect to hire this quarter, up from just 7% previously. On the other side of the coin, investment intentions also saw a marked recovery. Plans to invest in buildings turned positive for the first time since the end of 2021. Meanwhile intentions to invest in plant and machinery returned to positive territory, with a net 6% of firms planning to increase investment over the coming year.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.