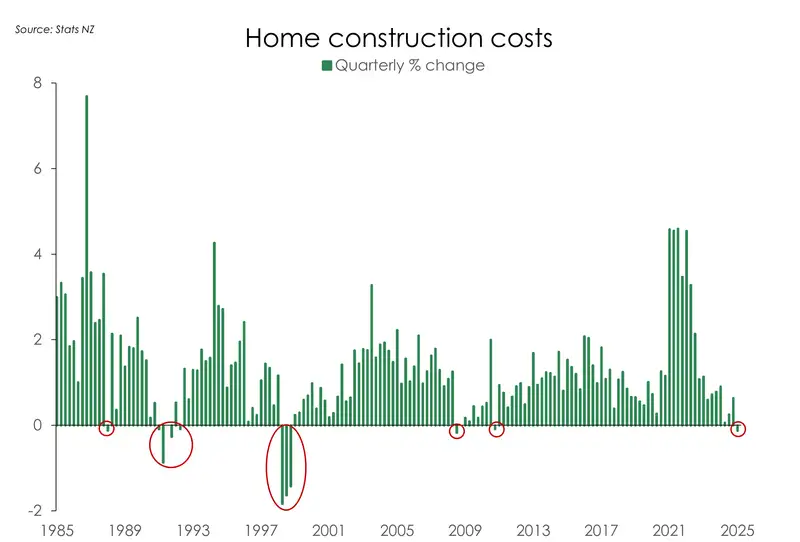

Domestic inflation continues its (slow) move south. Annual non-tradables inflation pierced below 4% for the first time in four years to 3.7%. Within that, housing-related inflation was significantly weak. Building costs fell 0.1%qoq – the first decline since March 2011. And over the year, costs are up just 0.8% - that’s the lowest we’ve seen since the GFC (Dec 2009). Those in the industry cited competitor price-matching as well as lower component and fitting costs as reasons for price weakness. Falling materials costs, like steel, match the anecdotes were hearing from developers. And wages within the industry have softened also. There’s less work. Such pricing weakness was flagged in the latest NZIER QSBO report, where the building sector reported the biggest fall in pricing – from a net 3% raising their prices to a net 35% decreasing their prices.

In some good news for builders, developers, and home DIYers, the Govt has given the “green light” on selected overseas building products that would otherwise have not been permitted for use in NZ – from plasterboard to external doors. While construction costs are now increasing at a more modest pace, it is still around 50% more expensive to build compared to pre-covid. The looser restrictions should see greater competition and better price regulation. 20% increases in building costs should (hopefully) be a thing of the past.

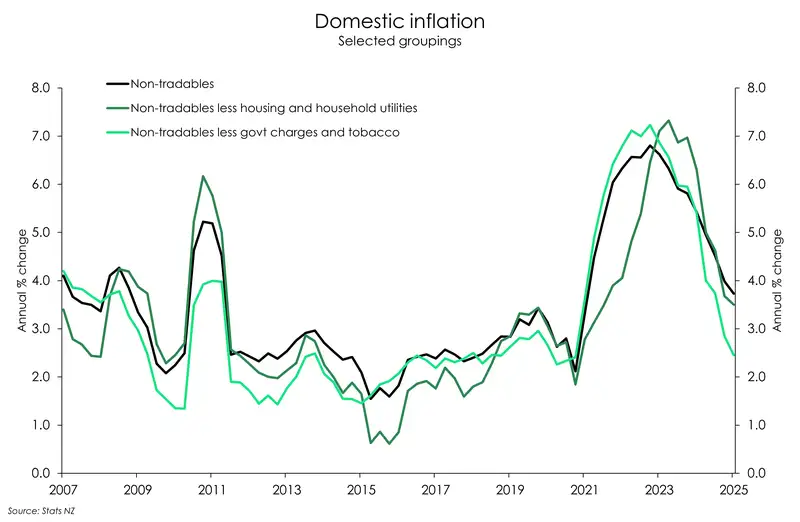

Domestic inflation has fallen some way from its 6.8% peak in 2023, but it is still sitting high above the long-term average (~3%). And that’s despite such a weak domestic economy. Such persistence is due to the lingering strength in administered prices. Council rates and insurance costs are running well above historic averages, up 12.2%yoy and 6%yoy, respectively. And households are now contending with high electricity charges, climbing to 9.1%yoy. If we exclude housing-related inflation, domestic inflation prints at 3.5% - the lowest since December 2021. Given excess capacity still sloshing in the economy, domestic inflation should continue to head lower. But the pace of easing is being dictated by factors largely outside of the RBNZ’s control. That’s a frustration.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.