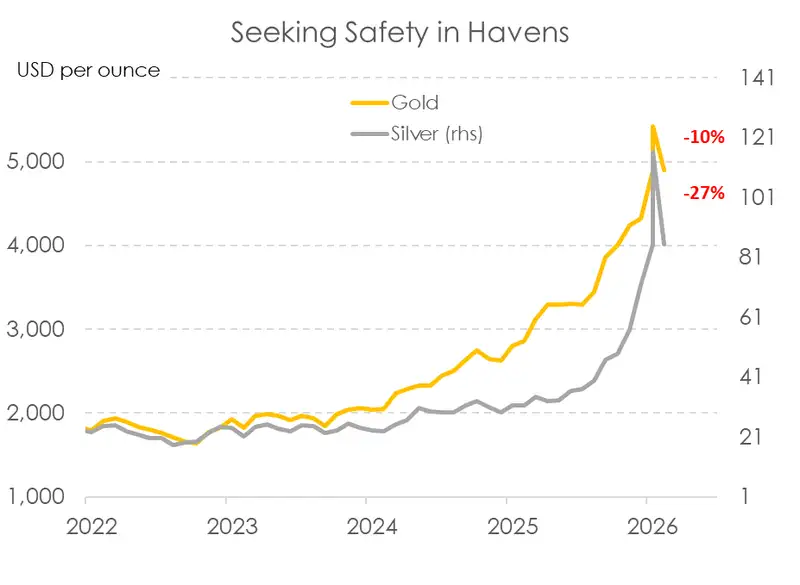

We have seen some savage moves in financial markets. The Anti-Trump, get me out of dollars trade, had seen gold and silver smash record highs… going to levels that were once theoretical only. The price of gold and silver became exponential over the last year. At $2000 per ounce in 2023 and coming into 24, gold surged through $3000, $4000 and burst into the dizzying heights above $5000. A remarkable run. And you can't forget gold’s poorer cousin, silver. Silver skyrocketed 415% from 2024 to $117. Well, we’ve hit a pothole, to put it politely. Gold is down 10% from the $5427 peak… and the price of the more volatile silver plunged 27% to $85.

Is it the end of the run in precious metals? Probably not. Markets get ahead of themselves. Traders push prices as hard as they can for as long as they can. And then there’s a circuit breaker… a dose of reality. Kevin Warsh becoming the next US Fed chair has removed much of the fear within markets around diminished independence. SO, a run of buyers found wanting, and sellers coming to the party, flipped the market. Exhausted buyers, determined sellers, and the market struggled to clear. There’s a lot to be said about liquidity in a market… any market.

The most liquid bond market, is also the largest, and it’s the US. As we’ve pointed out before, we have seen a rebalancing of funds, not a dumping of dollars. The decline in the US dollar looks dramatic, on a 10-year chart, but it’s not. Go back further, the USD was much lower in the post-GFC period. If there had been a dumping of dollars, the US Treasury yields would be dramatically higher, and they are not. A 10-year Treasury at 4.25% is bang of expectations of fair growth, stable inflation, and a small term premium. No fear here… not yet

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.