From spam in inboxes to flooded social media feeds, it’s that time of the year again – Black Friday. What began in the United States has gone global with many Kiwi retailers jumping on the bandwagon. The ‘unbeatable’ sales seemed to spring up everywhere you looked. The last Friday of November is officially the date. But with each year, the deals and discounts seemed to be advertised earlier and earlier. Indeed, looking at November monthly spend data for the past five years, the lift in volumes begins earlier in the month with each year – barring 2024 when the recession weighed on wallets.

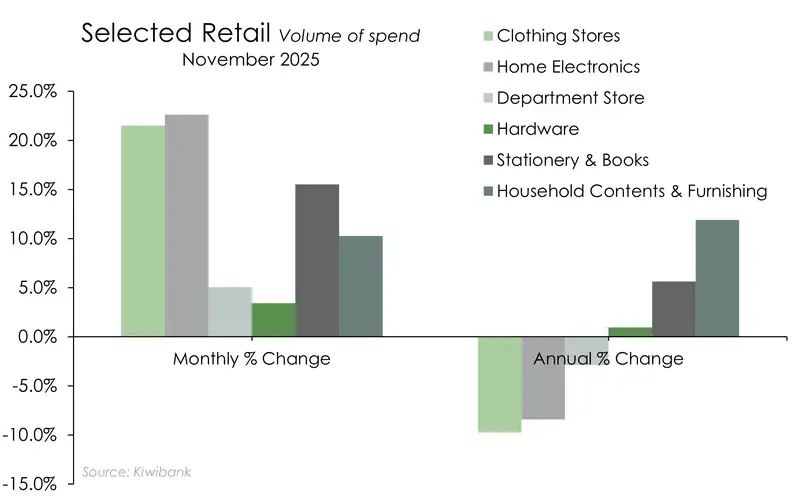

We trawled through Kiwibank electronic card transactions and uncovered signs of a pick up in discretionary spending. The volume of spend on core retail is still down 1.5% compared to November last year. But by sub-category, it’s more of a mixed read. This year, it looks like Kiwi favoured hammers over handbags, couches over Converse, and books over Bluetooth speakers. The volume of spend on clothing and footwear was down 9.7% on last year’s levels, while transactions at department stores fell 3%. Home electronics also recorded an 8.4% decline. But spend was up 1% at hardware stores and up 12% on all thing's household contents and furnishings. And as Kiwi are lounging on new hammocks, they’re reading the latest literature. The volume of spend on stationery and books is also up 6% compared to last year.

The lift in housing-related spend offers an encouraging sign for the housing market next year. The need for new furniture suggests increasing housing market turnover. While more trips to the hardware store sets up a summer of DIY. A lick of paint here, a mended fence there.

Overall, our data suggests that Kiwi are opening up their wallets more than last year – but they’re more selective with where their money is spent. For now, all things housing are the winners. But secret Santa and stocking stuffers may see more broad-based gains across retail this Christmas. Boxing Day also holds promise for more spending on toys – big and small.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.