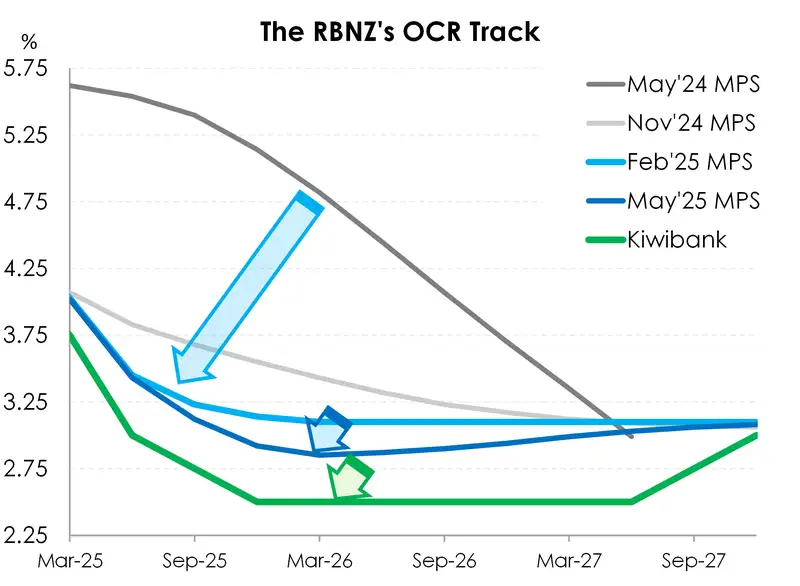

If you just read the statement, the RBNZ’s easing bias was strengthened. The economic forecasts were cut, and another 25bp rate cut was inserted into the OCR track (from a low of 3.1% to 2.85%). The track shows a clear bias to cut to at least 3% and there’s a 60% chance of a cut to 2.75%. That’s dovish. Because they’re still cutting. Our first chart shows with each MPS over the last year, the terminal OCR has moved closer to our 2.5% view. Give them time, and they just might get there.

The FX market read the statement. The Kiwi currency barely moved. The Kiwi currency reacted exactly as you’d expect. It fell. It rose. And then it fell again. It looked like a heart rate monitor around .5950. There wasn’t much change at all. There are bigger issues offshore for currency traders to grapple with.

If you listened to the press conference, the RBNZ’s top brass were crystal clear in their clouded uncertainty. Heightened uncertainty is making it harder for all policymakers to navigate. So, it’s not surprising to see the committee err on the side of caution. The fact the RBNZ “voted” 5-1, with one member voting for a pause to assess, throws some doubt on the timing of the next move, but not the direction. They are not on a “pre-set course”, and always data dependent. We think there’s enough for them to cut again in July, but they may wait until August to cut again. It depends… on what? Everything.

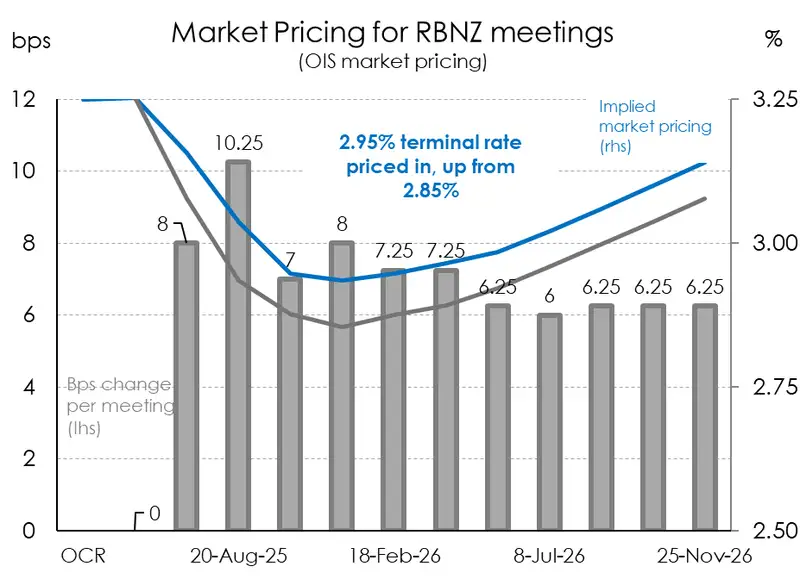

It was the “vote”, the first time in two years, that got interest rate traders (re)thinking. That seed of doubt caused a bit of a jolt, especially short end interest rates. The pivotal 2-year swap rate rose 10bps, from 3.16% to 3.26% (now 3.32%), as the implied terminal cash rate lifted from 2.85% to 2.95% (now 3%). See the second chart. It’s not a big move… but it was one Governor Christian Hawkesby pushed back on. The telling comment from Hawkesby, when asked about the market reaction, was his reference to the new OCR track matching market pricing prior to the announcement. The RBNZ’s OCR track matched market pricing of 2.85%. So they would not have expected much reaction at all.

We believe we are seeing some profit taking in wholesale rates markets. Hedge funds would have placed some bets that the RBNZ may have come out a lot more dovish.

We think the market will settle down, and end up moving back down to 2.85%, in time (and depending on what happens in offshore markets). And then, we expect another move by markets and the RBNZ down to 2.5%.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.