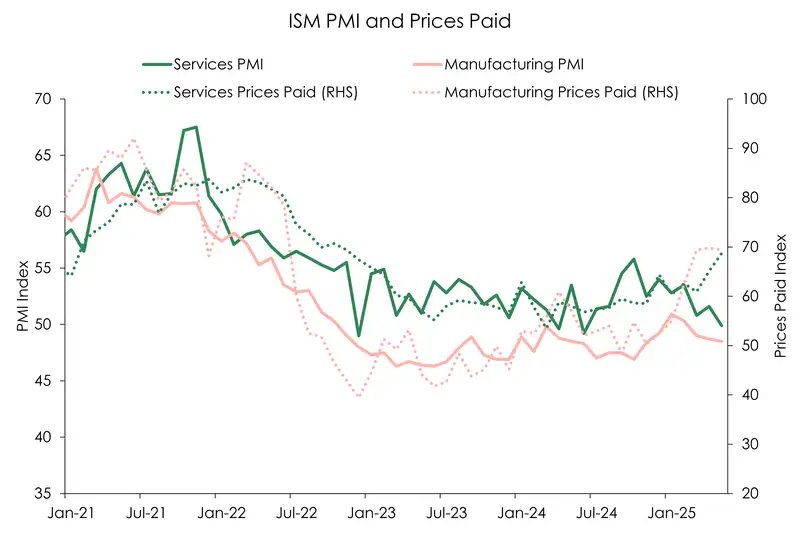

Cracks in the US economy are starting to form. The recent flow of high-frequency data isn’t looking too good. The ISM surveys for the month of May were especially disappointing. The manufacturing PMI fell from 48.7 to 48.5, the lowest in six months. And majority of its components also signalled contraction (a reading below 50). The new export orders fell 3pts, while production contracted for the third straight month and remains well below pre-covid levels. At the same time, the prices paid sub-index expanded for the fourth straight month, and the supplier deliveries sub-index rose 2pts suggesting a hoarding of inputs ahead of tariff escalation.

The services PMI posted a deeper slide in May. Economic activity in the sector contracted for the first time since June 2024, with the index plunging 1.7pts and slipping into contractionary territory. The drop in the headline index reflected a plunge in the new orders component, down 5.9pts. And the prices paid sub-index increased to the highest level in 30months.

Across both surveys, it’s clear that output is beginning to slow, while inflationary pressures are heating up.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.