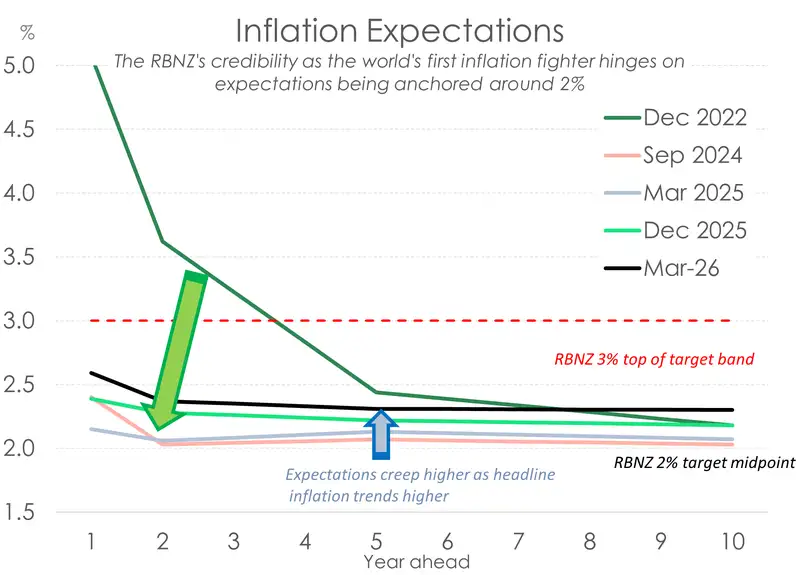

We’ve seen quite an ugly lift higher in the RBNZ’s Survey of Inflation Expectations. Across all time horizons, expectations of inflation have risen and moved further away from their September 2024 low’s when inflation expectations were anchored back at 2%.

The one-year ahead measure has climbed a whole 20bps higher to 2.59%. Meanwhile the two and five year ahead measures each lifted 9bps to 2.37% and 2.31% respectively. And painfully, the ten-year ahead measure lifted to a series high of 2.30%, surpassing the previous record of 2.28% seen in 2023.

Though unwelcome, the recent lift in inflation expectations does not come with much surprise. Indeed, inflation expectations have been edging their way higher over much of 2025 as headline inflation began lifting from its low of 2.2% to most recently 3.1% - a touch above the RBNZ’s target band.

The RBNZ may be feeling some discomfort around its credibility as an inflation fighter. Along with the risk that higher inflation expectations could become embedded in wage and price setting decisions, and thus reinforce upwards pressure on actual inflation. But we don’t think the RBNZ will, or should, be in panic mode just yet.

For starters, while the RBNZ would clearly prefer expectations closer to the 2% sweet spot, they’re still sitting comfortably within the 1–3% target band. And we don’t expect them to drift much further north.

Headline inflation is still expected to ease over 2026, helped by spare capacity in the economy. The recent 3.1% print should mark the peak in this latest bout, with headline inflation cooling over the year and expectations following suit.

In the meantime though, the RBNZ will of course be keeping a close eye on expectations. Monitoring such like a rash from a bug bite. Not panicking but checking to make sure it doesn’t spread beyond the red circle drawn around it. As long as expectations stay inside that boundary, and the medium‑term outlook remains one of cooling inflation, then we think the RBNZ can afford to watch carefully.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.