Monetary policy makers must look through short-term volatility, even if it’s eye-watering.

Inflationary pressures from offshore are heating up. Food prices are up 4.4%, reflecting elevated global commodity prices. Higher prices for fruit and vegetables as well as meat drove the increase in food prices in May, up 3.6% and 1.7%, respectively.

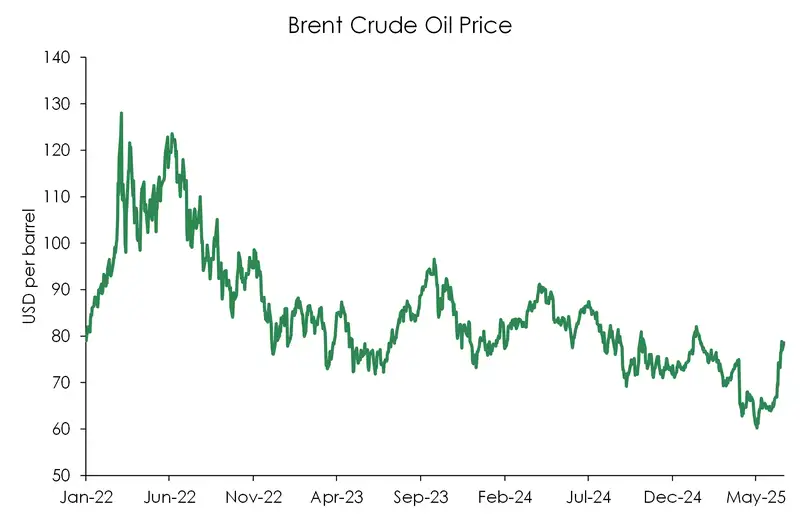

Petrol prices fell 2.7% in May, but a reversal is likely this month following the conflict in the Middle East. Global oil prices are almost 20% higher since the start of the month.

Domestic inflation continues to ease, but frustrations remain. Rents for example, have cooled rapidly, rising just 0.1% over the month. Annual rental inflation is running at 2.8% - the slowest pace since January 2015. Household energy costs however are on the rise, up a chunky 2.3% over the month.

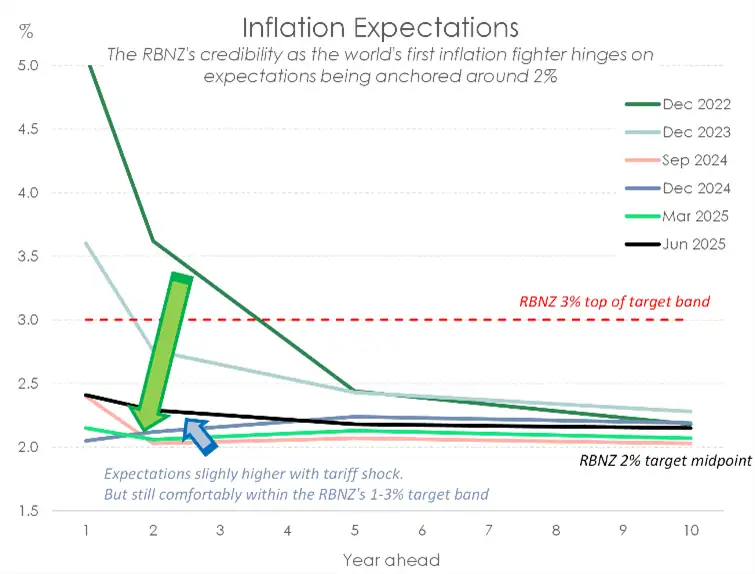

The risk here is that inflation flirts with the top of the RBNZ’s target band in the near-term. We had already pencilled in a move towards 2.7% this year. But it’s looking like we’ll see a higher peak. In saying that, downside risks dominate the medium-term. Consumer prices will come under pressure amidst slowing global demand and excess capacity in the economy. There’s risk that inflation falls below the RBNZ’s 2% sweet spot, which would necessitate further monetary policy support.

The typical play for central bankers facing a spike in inflation is to look through it, especially if it is the result of a shock. Such is the case for the recent increase in oil prices. The impact should be temporary and an unwind likely. But as we’ve learnt from the RBNZ’s last meeting, there’s nervousness around rising inflation expectations.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.