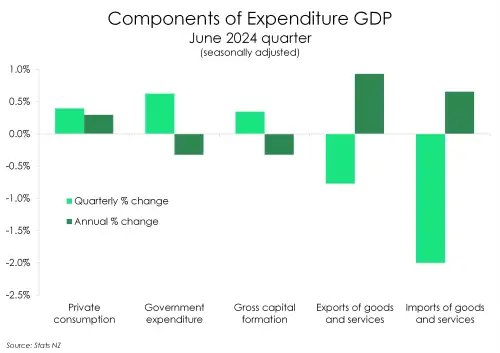

Another way of calculating Gross Domestic Product is by the expenditure approach which combines household consumption (C), business investment (I), government spending (G), and net exports (exports (X) minus imports (M)). And the expenditure measure offered a more encouraging view of the Kiwi economy – but only by a smidgen. Expenditure GDP was flat over the June quarter. Household spending, government spending and business investment were all up over the quarter. But the gains made across these three components were offset by the 0.8% decline in exports. And leading the decline was the 4.4% fall in goods exports. The 1.4% decline in agri production was mirrored by falls in exports of dairy and forestry products.

Household consumption increased 0.4% over the quarter, far stronger than the 2.2% decline the RBNZ had pencilled in. Despite the June quarter jump, private consumption remains weak with the March quarter print significantly downgraded from 1.6% to 0.5%. Mirroring the decline in retail trade on the production side, consumption of durable goods declined a chunky 3.4% over the quarter. And compared to last year, durable spend is down almost 10%! – the fourth straight annual decline. Households are reining in their big-ticket spending as tight financial conditions weigh on wallets. And the rotation away from goods and towards services continues. Consumption on services increased, albeit by a smaller magnitude compared to the start of the year, up 0.8%.

Annual services consumption increased 1.3% - the first positive print since September 2022, but still running well below the long-term average.

Beyond households, business investment picked up with a 1.1% over the quarter. Investment in plant and machinery lifted almost 2%. Similarly, the downtrend in building consents has seen a 5.8% decline in residential buildings compared to a year ago. Nonetheless, overall gross fixed capital formation eked out a 0.2% gain over the quarter – the first increase after four quarters in decline.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.