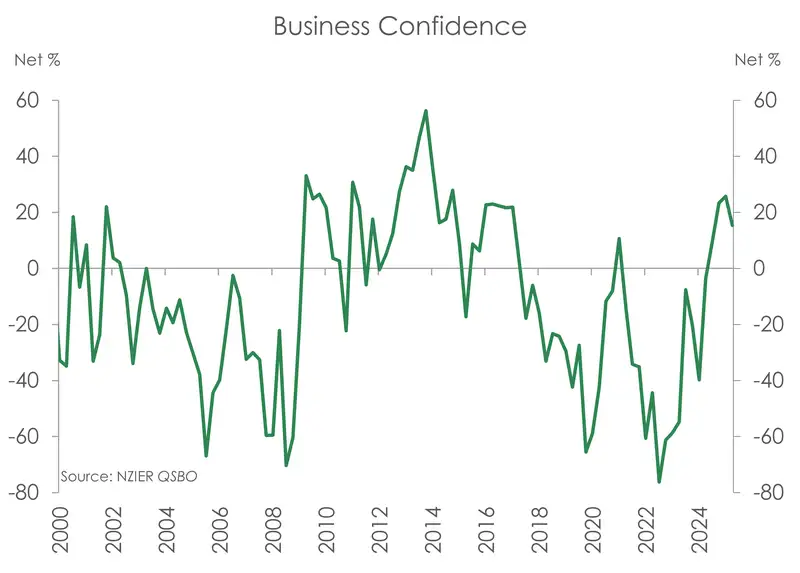

- Business confidence is waning. Because the expected recovery in demand has disappointed. For almost two years now, firms have reported a decline in activity. Now, a smaller share of firms are feeling upbeat about the outlook. Not even the RBNZ’s dovish pivot in August has managed to boost sentiment.

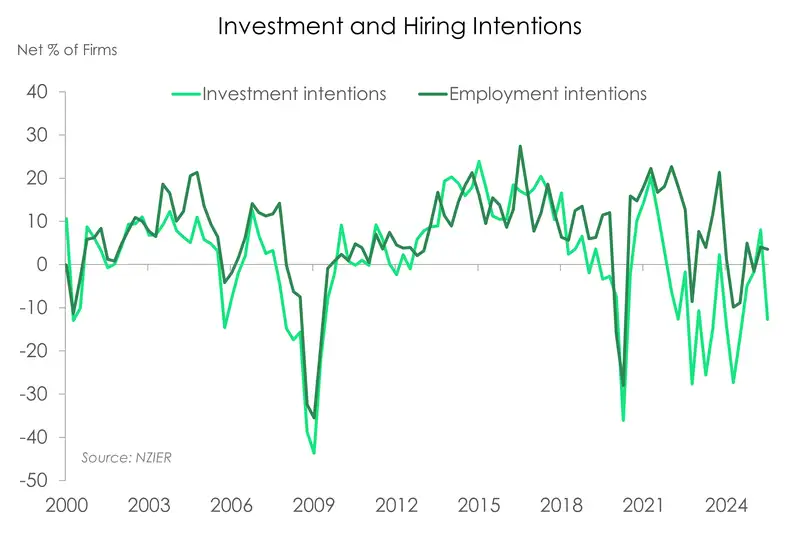

- The disappointment in the here and now, plus the loss of optimism about future conditions, has sent investment intentions sharply back into decline. Conditions are simply not right for businesses to be investing or expanding.

- The economic recovery is lacking gusto. There’s a clear need for stimulatory interest rate settings. Today’s update supports a 50bps cut to the cash rate tomorrow.

For the past year, business confidence had been steadily improving. But that optimism waned over the September quarter. According to NZIER’s latest business survey, fewer firms expect brighter days ahead. Only a net 15% expect economic conditions to improve in coming months, down from a net 26%. The weakening in sentiment reflects disappointment in the expected rebound in demand.

Another theme that has continued over the past year is the weakness in firms’ own domestic trading activity. Again, a net 14% of firms reported a decline in activity over the quarter. And a net 63% of firms (greater than the long-run average) put demand as the primary constraint on their business. Firms are still holding out for the recovery. Although fewer firms are now convinced. A net 9% of firms expect own trading activity to lift in the coming quarter, down from a net 18%.

The latest update in business sentiment comes as no surprise to us. We are hearing the same feedback on the ground (see our note, “The Travelling Economist: It’s darkest before the dawn”) and it’s being reflected in data. The Kiwi economy is underperforming and clearly needs stimulus. More accommodative interest rate settings are required. This report supports a 50bps cut tomorrow.

The dichotomy between reality and expectations is most stark within the retail sector. A net 29% of retailers expect an improvement in economic conditions. But even among the most optimistic, optimism is waning. That 29% is a significantly smaller share than the net 40% that felt upbeat in the previous quarter. The ongoing weakness in demand continues to drag on activity. More retailers reported a drop in new orders and weaker domestic sales over the September quarter. Retailers are clearly looking to the upcoming holiday trading period, and hoping for a turnaround.

Manufacturers were the least optimistic, with a net 3% expecting an improvement – that compares to a net 20% in the previous quarter. A net 38% of manufacturers also reported a reduction in activity over the September quarter. NZIER suggests weak export demand as the main culprit. The lower Kiwi dollar should help in coming months.

With weak activity, a deterioration in confidence, and the skies seemingly darker ahead, it was no surprise to see investment intentions fall back into decline. Last quarter we finally saw a lift in investment intentions back into positive territory after practically 13 consecutive quarters of plans to reduce investment (excluding the blip higher following the election). But it seems that move was short lived with firms now reporting a paring back in investment plans for the coming year. For plant and machinery, a net 13% of firms are now planning to reduce investment, compared to the net 8% that were planning to invest last quarter. Investment intentions are even bleaker when it comes to buildings. A net 20% of firms are planning to reduce building investment over the coming year, up from the net 8% last quarter. None of this comes as a surprise. Why invest and expand when you’re worried about demand, revenue, and profitability? That’s what we’ve heard from Kiwi businesses across the country. The conditions are simply not yet right. Talks of investment, even with the Government’s investment boost scheme, are still too early. The scheme should stimulate investment, in time, but the lack of demand domestically is hindering the decision to expand. We shone a light on this recently in our note “Investment Boost: Just a cherry on top for well-placed businesses?”. We asked our clients if they were considering taking up the Government’s “Investment Boost”. The answer? Two thirds of the survey responses were no…

In the same vein, hiring remains muted. Over the September quarter, nearly a quarter of firms reported that they have slashed headcount, up from a net 12% last quarter. And looking ahead hiring intentions have virtually remained unchanged with still only a net 4% looking to hire in the coming quarter. Most of which seems to be coming from the services sector as the only sector showing a positive outlook for employment growth. Meanwhile, the outlook remains most grim for the manufacturing sector, which reported the most significant reductions in headcount over Q3. Over a net 25% of manufacturing firms reported cutting staff in the September quarter, and nearly 20% of firms remain looking at reducing headcount by the end of the year.

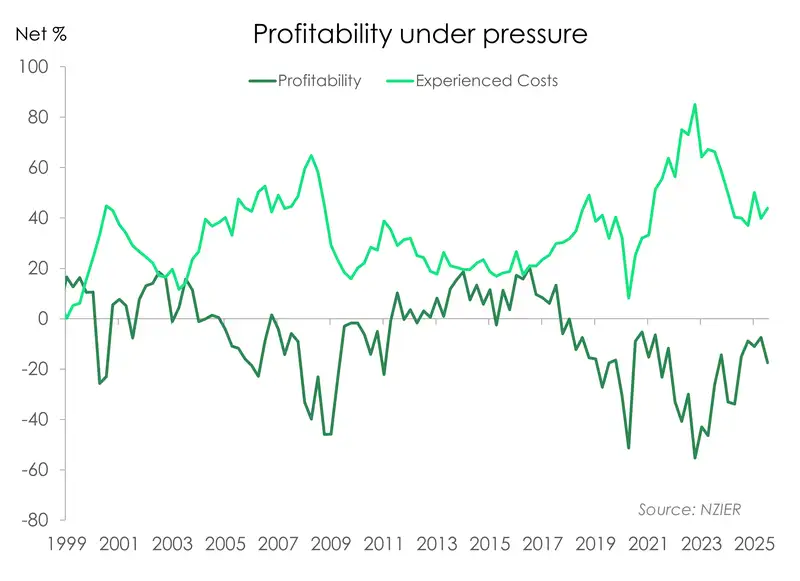

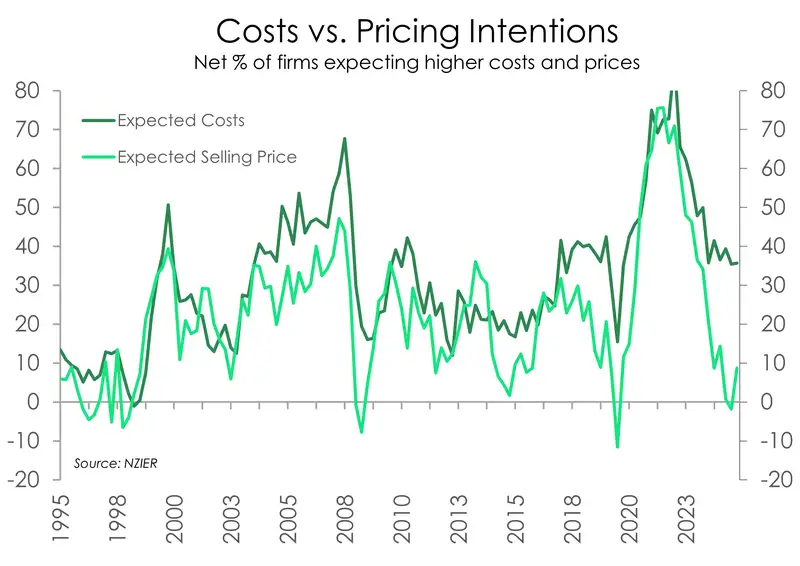

Simply put, businesses remain in a difficult situation. They’re having to gut costs when and where they can in the face of ongoing pressure on profitability. A net 40% of firms reported a decline in profits last quarter, up from a net 30%. Across all sectors, costs pressures have remained elevated. But coinciding with weak demand has limited business’ ability to pass on the costs to consumers. Only a net 11% of firms raised prices over the September quarter, and just a net 7% of expect to lift prices in the coming months. This does however contrast with the net 1% of firms that cut prices in the June quarter and the net 2% of firms that had expected to cut prices going forward. However overall, the proportion of firms increasing prices remains historically low, indicating subdued inflationary pressures.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.