- The pace of the economic recovery quickened over the start of 2025. Economic activity lifted 0.8% over the March quarter. It’s nice to have some good news. But we’re holding our horses as we expect the current pace to dissipate over coming quarters.

- Today’s dated report doesn’t reflect the more recent negative effects of tariff uncertainty on Kiwi growth. But it’s coming. More timely indicators are already starting to point to a slowdown. And we expect those headwinds to become more evident in the June quarter GDP figures.

- There’s still evidence that interest rate sensitive areas are struggling, highlighting the need for further monetary policy support.

The Kiwi economy has continued on its path to recovery, with some strength. Economic activity lifted 0.8% over the March quarter, slightly outpacing our expectation of 0.7%. The report was significantly stronger than the RBNZ’s 0.4% forecast. Although the prior quarter’s lift of 0.7% was revised down to 0.5%. Momentum from last year has carried through into early 2025. It’s nice to have some good news. But we’re not out of the woods yet.

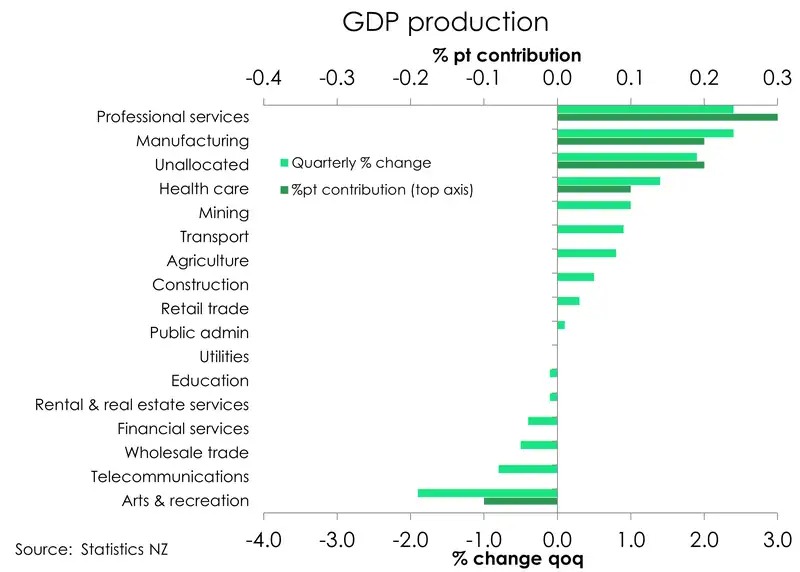

Activity lifted across 9 of the 16 industries over the quarter. That’s good, but not great. One of the pleasant upside surprises in the report was business services. Up 2.4%, business services contributed the most (0.3%pts) to growth over Q1. A lift in computer system design and related services boosted the industry. That’s great. But we remain cautious around the ongoing decline in hours worked in the economy. Still, 6 industries fell over the quarter. Industries including wholesale trade, real estate, recreation, info media and financial services posted declines over the quarter. The interest rate sensitive sectors remain weak… and highlight the need for further monetary police support.

Less surprising, given the strength in the PMI survey at the beginning of the year as well as high sales volumes, was the strength seen in manufacturing. The industry posted a solid 2.4% increase in output, which accounted for 0.2%pts of the headline growth. Manufacturing output is up 1.9% compared to a year ago, breaking 9 consecutive annual declines. An in a welcome surprise, construction posted it's first quarterly increase in over a year.

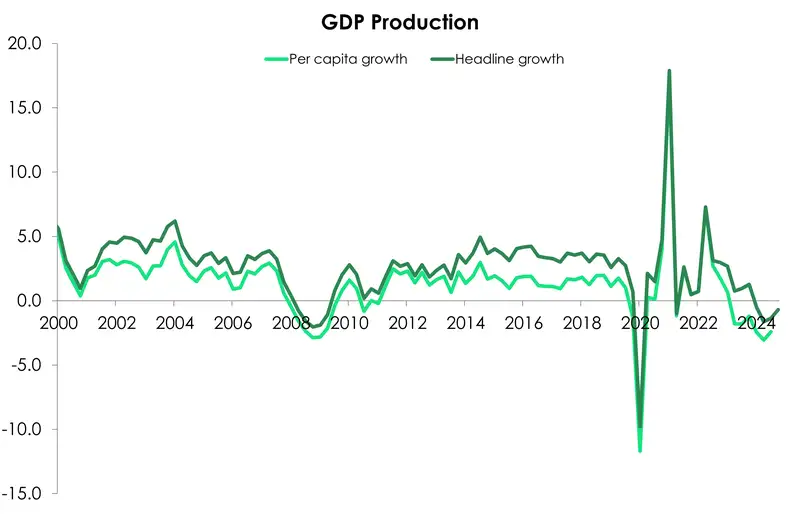

The economy remains 0.7% below pre-recession levels. And in the year to March 2025, the Kiwi economy shrank 1.1%. We’re still crawling out of the deep hole we fell into last year. A hole which has been even deeper on a per capita basis. On a per person basis, economic activity lifted 0.5% over the quarter but remains down 1.6% over the year.

Unfortunately, we may be crawling for some time longer. From here out, we’re not expecting to see the same strength seen over summer period sustained. We expect that the damaging effects to growth from tariff volatility and uncertainty have already started to take effect this quarter. And we expect those headwinds to become more evident in the June quarter GDP figures.

More timely economic data are already starting to point to a slowdown. Electronic card spending has softened, and both the manufacturing PMI and services PSI fell sharply back into contraction in May. Weak confidence amid economic fragility and tariff uncertainty is resulting in softening demand. And it’s under these conditions that we’re expecting a weaker Q2 GDP outturn than the strong prints over the summer period

We also want to flag that the recovery we’ve seen to date has been largely concentrated in the external sector, particularly across strength in the primary sector. Today’s report marked another strong lift of 0.8% for the primary industries. But it is precisely the external sector most exposed to further potential global shocks and trade turbulence.

To avoid ending on a sour note, it’s worth acknowledging that we are through the worst of it. However, downside risks to the global outlook remain a significant headwind for the Kiwi economy’s recovery. And as a result, our recently revised forecasts for the Kiwi economy does entail a slower pace of recovery ahead. Check out latest note “We’ve updated our forecasts, as we think our way through tumultuous times” for more on our outlook for the Kiwi economy from here.

The Breakdown

Delving deeper into the details, it was the services sector up 0.4% over the quarter – largely thanks to the lift in business services - that led growth over Q1. However, it was also across the services sector that saw 6 industries post declines over the quarter. The biggest decline and drag on growth over the quarter was in the arts & rec industry which fell 1.9%. Meanwhile, rental, hiring, and real estate services remained lacklustre, edging down 0.1%. Despite interest rate relief gradually filtering through, consumer spending and the housing market are clearly still subdued and highlight the need for further monetary policy support. Especially as an ongoing headwind of a deteriorating labour market continues to cast a shadow over several components of the economy.

The goods producing sector also shined bright this quarter, up 1.4%, thanks to the strongest lift in manufacturing in three years. Unfortunately, it seems like the strength in manufacturing may be short-lived. The latest survey showed the PMI plunging sharply from 53.3 to 47.5, bringing it close to the recession-level lows we experienced last year. And, along with the headline rate, most of the sub-indexes posted a great fall too. For example, new orders dropped 5.5 points to 45.3. Meanwhile, the employment sub- index fell 8.9 points to 45.7 – the largest single monthly fall in the survey’s 22-year history! So, it’s not looking great for manufacturing from here.

Meanwhile, performing better than we thought, construction actually posted a lift in activity over Q1! Up 0.5% it’s the first quarterly lift in over a year but still the rise comes off a very low base. Last quarter seemed to mark the bottom of the cycle for construction with activity down a massive 12.4% over the year. But today we’re still down 8.9%. Theres a long way to go in climbing out of this one. And with the housing market still muted it will be a slow climb.

Finally, the primary sector performed largely as we expected, maintaining its ongoing momentum. Agricultural activity increased by a further 0.8% over the quarter, matching the rise seen in the previous quarter. Stronger export prices—which rose 17% in the year to March 2025 —and the weaker Kiwi dollar at the beginning of the year, have provided a helpful boost to activity in this sector. However, we continue to flag the risk that the agricultural sector remains on the frontline of trade disruption and most subject to weaker global growth as demand for our exports wanes.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.