- Kiwi inflation broke above the RBNZ’s target band to finish 2025 at 3.1%. And it’s not just fuel prices and airfares that came in hot. The usual discounts over the holiday period disappointed, and there’s renewed strength in housing inflation.

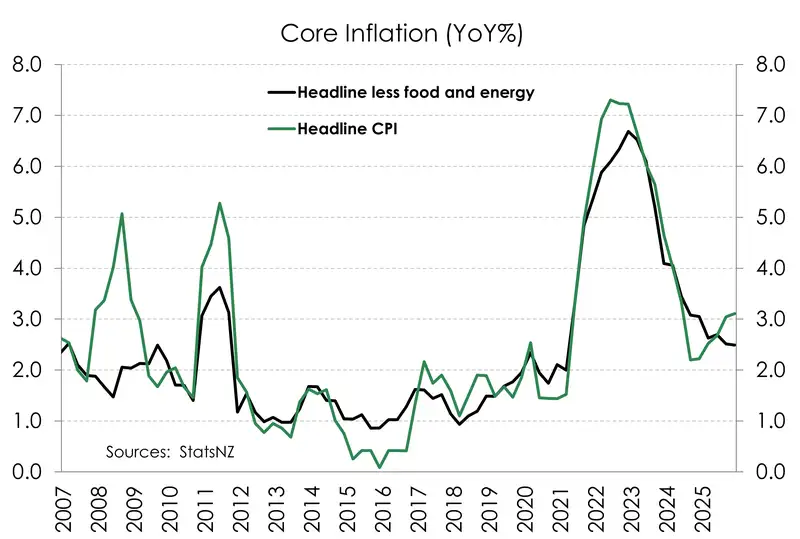

- Headline came in hot. And so did underlying inflation. Core measures of inflation are lingering at the upper-end of the RBNZ’s 1-3% target band. We can’t just put down the rise in inflation to just a handful of items.

- Today’s inflation print was not what we wanted to see. Nor the RBNZ. They were expecting a drop to 2.7%. Over the coming year, we still expect inflation to fall back within the RBNZ’s target band. But the stickiness in inflation suggests that the next move for the RBNZ is more likely to be up than down. Though we think that’s a story for another year (2027).

Today's inflation print was no good... no good at all. We thought we were getting some pretty good deals over the Black Friday to Boxing Day sales... apparently not. There was more inflation in retailing than we had imagined, assumed and come to expect. Back in 2024, discounts were coming out of our ears. Clothing, footwear, household furniture – you name it, prices dropped. 2025 broke the trend. Alongside less discounting, today’s update also teased renewed strength in construction costs. But it’s too premature and indeed unjustified to suggest a shift in demand just yet. Recent business surveys still lament the lack of demand. Rather, it seems that costs are building up and squeezing profit margins even tighter.

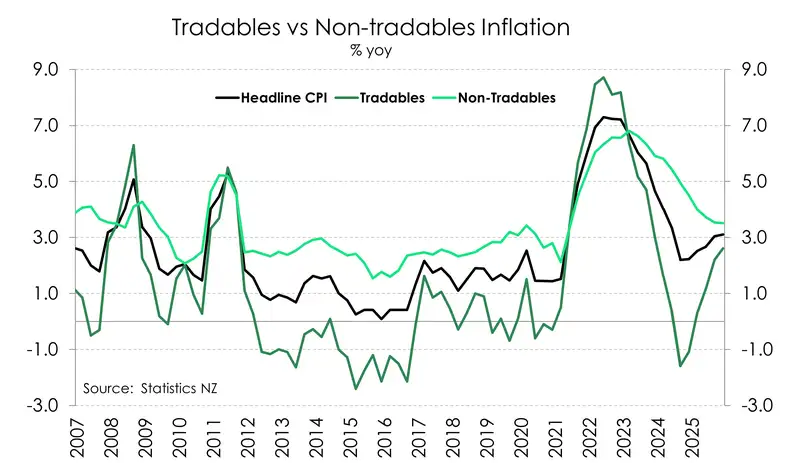

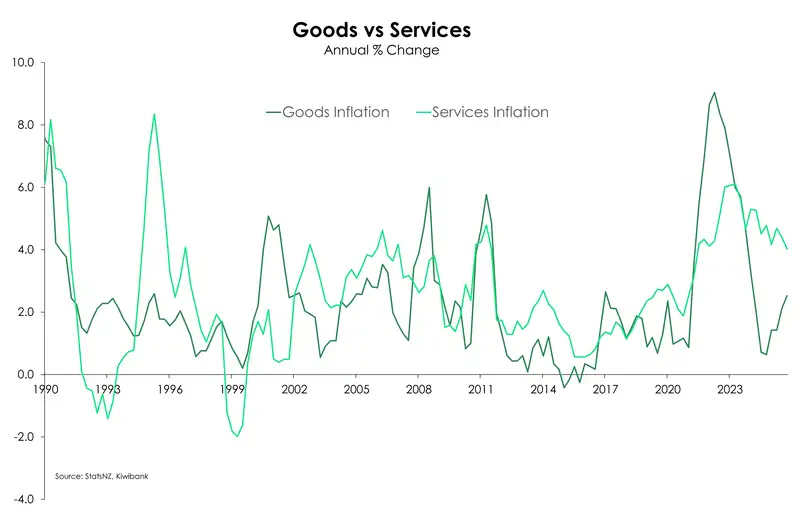

The headline print of 0.6% on the quarter, and 3.1% over the year was slightly above our forecast 3.0%... but it was the dirty details that did us in. There was a lift in petrol prices and airfares... we saw that coming. And tradables (imported) inflation lifted 0.7% to 2.6%. Not helping. But it was the heat in the domestic inflation that disappointed us the most. Non-tradables (domestic) inflation lifted 0.6%, running at 3.5%. We need that back down at 3% or below. Housing and utility costs remain heated, with electricity prices sparking concern at 12.2% over the year. There was also a notable lift in home construction costs. With construction contracting, you'd expect cost pressures to be easing. Not in this quarter. It feels to us to be more of a cost push, rather than demand pull type of inflation. And the one area of improvement, services inflation, dropped to 4% from 4.4%... but again, not low enough.

Another concern is that we can’t just point the finger at administered costs for higher inflation. For some time, it had been items like council rates, electricity and the like, pushing headline inflation higher. But if we remove these government charges, headline inflation is within the RBNZ’s target band but is pushing higher – from 2.4% to 2.6%. There are other (frustrating) hot spots within the CPI basket. And that’s also reflected the stickiness in underlying inflation. Excluding food and energy prices, core inflation held at 2.5% after being on a general downtrend since hitting the peak in late 2022. Trimmed mean is another way of excluding volatility in inflation, and that measure accelerated to 2.8% from 2.5%. That’s not what we wanted to see.

Kiwi inflation ended last year outside of the RBNZ’s target band, and well above their November forecast of 2.7%. We still expect inflation to fall back within the RBNZ’s 1-3% target band. A move below 2% however looks less likely given tentative strength in domestic inflation – even if we exclude housing (rates and utilities).

The newly minted Governor and RBNZ officials are “laser focussed” on inflation, as they have always been. Above-target inflation and the plethora of good news, especially the lift in business confidence, means the need for further rate relief is evaporating, fast. Market traders have turned their attention to the possibility of rate hikes (not cuts) this year, with two full hikes priced in wholesale rates markets (namely the OIS strip). We agree, the next move is likely to be a hike. And we hope that is the case. Because rate hikes follow an economy that has recovered. But we think it is still a story for 2027. Although the risk of a hike this year is steadily increasing.

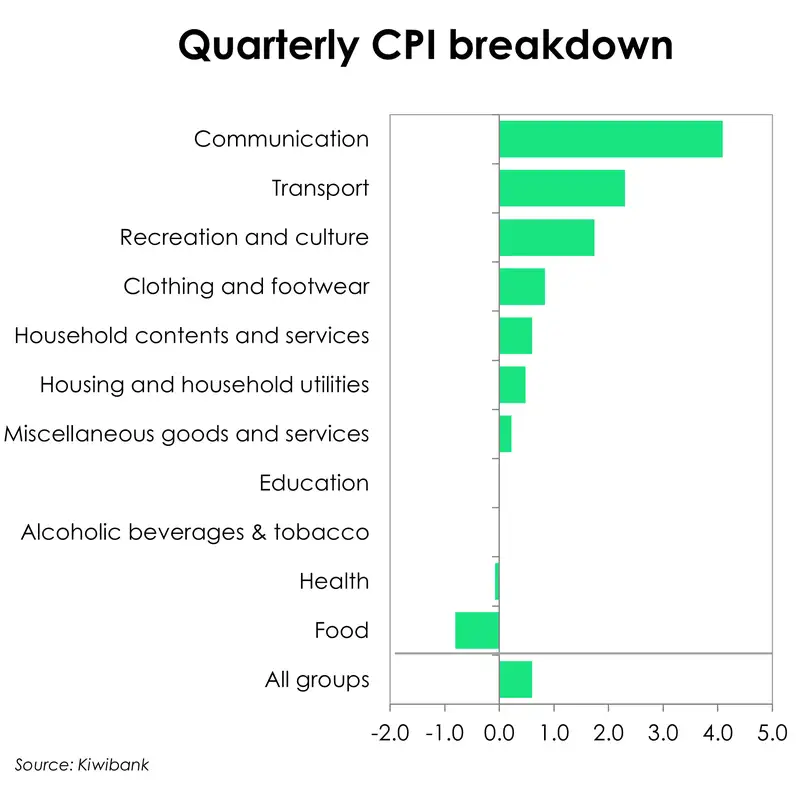

Basket breakdown

Taking a closer look at the basket, it was the transport group, up 2.3% which contributed the most to the 0.6% lift in prices over the quarter. Within that, international airfares were up 7.2% and accounted for a fifth of the overall quarterly lift in prices. Seasonal factors are in play here with the start of the busy summer tourism season typically seeing a lift in prices. Meanwhile petrol prices, up 2.5%, over the quarter also contributed around 13% to the lift in prices over Q4. We suspect that the weaker currency had an impact here as global oil prices were instead lower over the same period.

Away from transport, the 4.1% lift in prices for the communication group also played a role. Increases to mobile phone plans (as well as tweaks to StatsNZ’s price models) explains the strong increase.

What was really surprising for us, was the strength, or rather lack of weakness, across retail goods. The December quarter is typically the weakest quarter for inflation because of seasonally soft food prices and the usual round of retail discounting that comes with the holiday period. We saw the softness in seasonal food prices, down 0.8%. But we didn’t see the same discounting across retail goods. The percentage of retail goods that were discounted over the December quarter dropped to just 15% down from 20% the same time last year. And the average discount applied was 10%, smaller than the 13% a year ago. For household furniture specifically, the average discount was just 3% compared to the 11% in December 2024. Discounts in 2025 just didn’t stack up to previous years. Instead prices for clothing & footwear increased 0.8%, while household contents & services lifted 0.6%. Both stronger prints than we had expected.

Another point of interest was the uptick in prices across construction. Up 0.6% over the quarter, we thought construction prices would be softer given the still slumped housing market. According to a StatsNZ survey, the lift in prices seemed to stem from an increase in building price components across fittings, subcontractor charges and power.

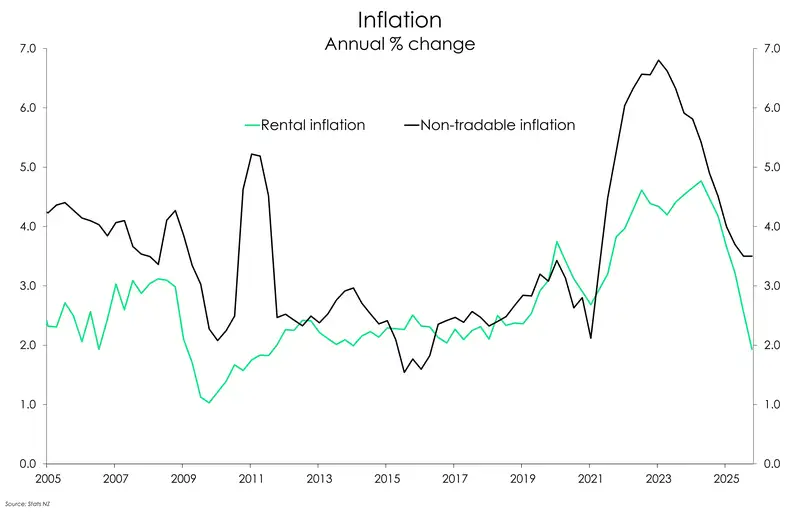

At least to no surprise, rental inflation remains weak. The annual rate of inflation across rents eased to just 1.9%, marking the smallest increase since the start of 2014.

Meanwhile annually, administrative costs continue to bite. Electricity prices up 12.2% remains at their highest since the late 1980s. Such a lift contributing just over 10% to the 3.1% rise in prices over the year. Pair that with council rates, up 8.8%, it’s clear that the housing & household utilities group remains the area where most of the inflation pain is being felt.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.