- The Kiwi economy staged an impressive rebound in the September quarter. And off an even deeper contraction in Q2. Economic activity lifted a solid 1.1% over Q3 with strength spreading across almost all industries. The external sector continues to shine. But we're seeing a resurrection in interest rate sensitive sectors too.

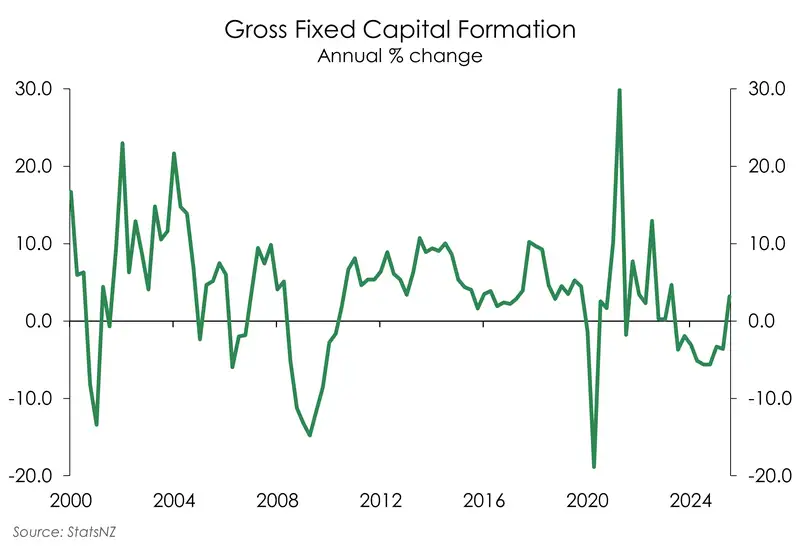

- A big highlight in today's report is the lift in business investment. Up 3.2% over the quarter, it's the strongest quarterly lift in three years. Increased confidence in the outlook is turning into action. That’s the data we’ve been waiting to see.

- We’re climbing our way out of the deep dark recession of 2024. But output today is still 0.6% below peak levels seen in March 2024. But our September economic report card confirms a brighter outlook ahead.

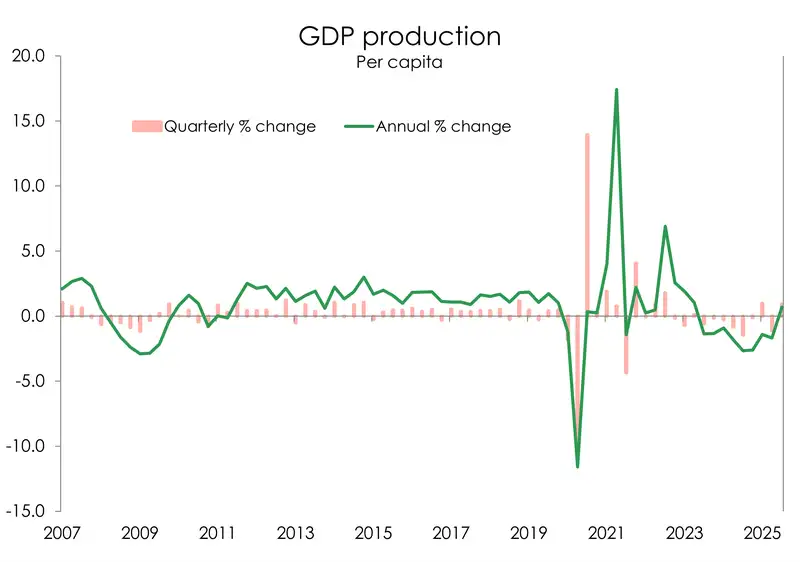

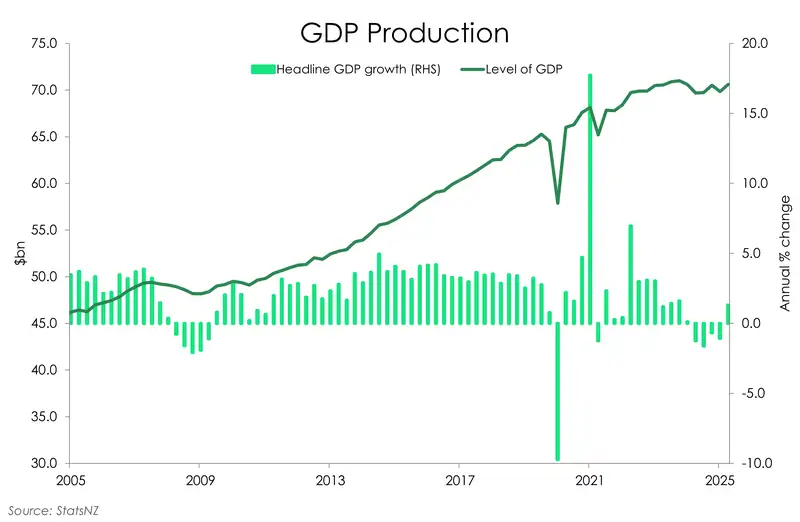

We’re finishing the year on a positive note. Output across the Kiwi economy lifted a solid 1.1% over the September quarter. The bounce out of the June quarter contraction was impressive, especially because it follows a weaker than initially printed reading (now -1.0%, previously -0.9%). Looking back at 2024, the recession was a touch shallower and more weighted into the September quarter, making the annual rate of +1.3% look a little stronger. On a per person basis, economic activity rose 0.7% over the year. That's a welcome improvement. The broad-based nature of the bounce was expected, but good to see confirmed. Of the 16 measured industries 14 recorded gains. Services were strong. No doubt helped by the lift in hours worked over the quarter. And we saw meaningful gains in retail and construction - the two industries hardest hit, most interest rate sensitive sectors.

Expenditure GDP showed an even stronger lift in activity, up 1.3% over the quarter following an (upwardly revised) 0.8% slide in Q2. And it was our external sector on full display. Exports were up 3.3% over the quarter. Within that, services jumped 4.3%. The recovery in tourism has played a big role, as visitor arrival numbers close in on pre-covid highs. Goods exports grew 3.7%, led by a 9% increase in dairy products. The last 12 months have been good for dairy, with exports up 7.4%. But there’s been less love for our meat abroad, with exports down 1.4% on the year. That may well rebound in the current quarter given that President Trump lifted the reciprocal tariff on select agri products, including beef. That’s great news for us.

The September quarter also saw business investment shine. Gross fixed capital formation increased 3.2% over both the quarter and year. That’s the strongest quarterly print in three years. We love to see it. Businesses invested more in physical fixed assets over the quarter, with increases in transport equipment and plant, machinery, and equipment. On the household side, consumption grew just 0.1% and but almost 2% higher compared to a year ago. In the September quarter households spent less on services (-0.1%) and non-durable goods (-0.2%), but more (2%) on durables. And it was everything electronics that filled the shopping carts.

The September quarter rebound is impressive. But the overall size of the economy has largely returned to where we were at the start of the year. The level of output is just a touch (0.1%) above Mar-25 levels. And reflecting the depth of the recession in ’24, output today is still 0.6% below the recent peak in Mar-24. Zooming out, we’ve essentially been tracking sideways for the past two years.

That said today’s report card for the Kiwi economy confirms that we’re on the road to recovery. And things should only get better from here. High frequency data for the months of October and November reflect that activity is gathering momentum into the final stretch of 2025, setting us up for an even better 2026.

We’ve updated our forecasts for the year ahead and are excited for what’s to come. Interest rates are at levels that are encouraging activity. 2026 should see a return to long term average rates of growth with potential for the economy to enjoy a period of above trend growth in 2027.

The Breakdown

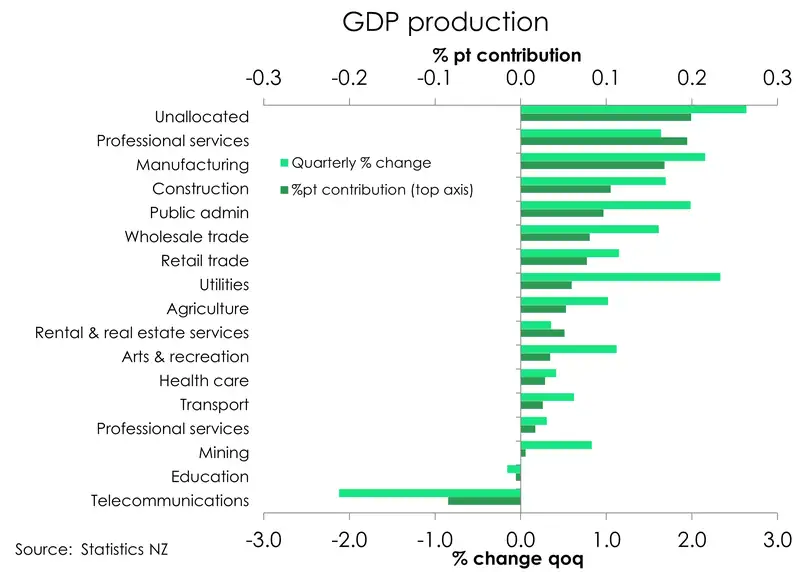

Though largely as expected, the overall report card for the Kiwi economy over the Sep quarter was one of broad-based strength. Just two of the 16 measured industries (education and Info media services) saw declines in activity over the quarter, while the rest posted gains.

The services sector led the charge, driving most of the 1.1% lift in the headline rate. Up 0.8% overall, the lift in services was reflective of the rise in total hours worked seen over the September quarter. It was a tailwind we had previously flagged for both the professional services and the wider services sector. And that’s exactly what we’ve seen play out. Professional services rose 1.6%, contributing 0.2%pts to the headline quarterly print. But the strength across services spread far and wide. And importantly extended to interest-sensitive sectors such as arts & recreation, retail, & accommodation, and beyond. The only notable weak spot was a 2.1% fall in information media services, driven by declines in telecommunications, motion picture, and publishing. The dwindling Kiwi media landscape undoubtedly playing a role there.

Goods-producing industries also staged a strong comeback. After contracting 2.8% in the June quarter, the sector grew by 2%. Manufacturing was the standout performer, rebounding 2.2% after being the biggest drag with a 4% contraction in the June quarter. But the turnaround contributed 0.17%pts to Q3’s growth. The improvement was largely foreshadowed by PMI readings holding in expansionary territory throughout Q3. Increased production across food and beverage manufacturing matched the 3.7% lift in goods exports.

The one to watch, construction, is showing promising signs lifting 1.7% over the quarter. On the year, construction remains down 3.6%. But that’s a marked improvement from the -8.7% decline in Q2. With consents trending higher and a warmer housing market expected into next year, we expect momentum should continue to build (pun intended).

The strength of the external sector continues to boost the primary sector which rose 1% overall this quarter. Most of the lift came from agriculture, up 0.7%. Though forestry did rebound strongly up 4.7% after a 2% fall last quarter. Overall improvements across the primary industries are consistent with stronger export volumes over the quarter.

Looking ahead, we could see some easing in production across the agri space with dairy prices retreating from recent highs. Elevated dairy prices had previously supported increased output, but that dynamic may now be shifting as an oversupply weigh on prices. However overall, this could be offset by ongoing strong demand for Kiwi meat and a sturdy outlook for meat prices. Especially now that we no longer face a 15% tariff on our meat exports to the US.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.