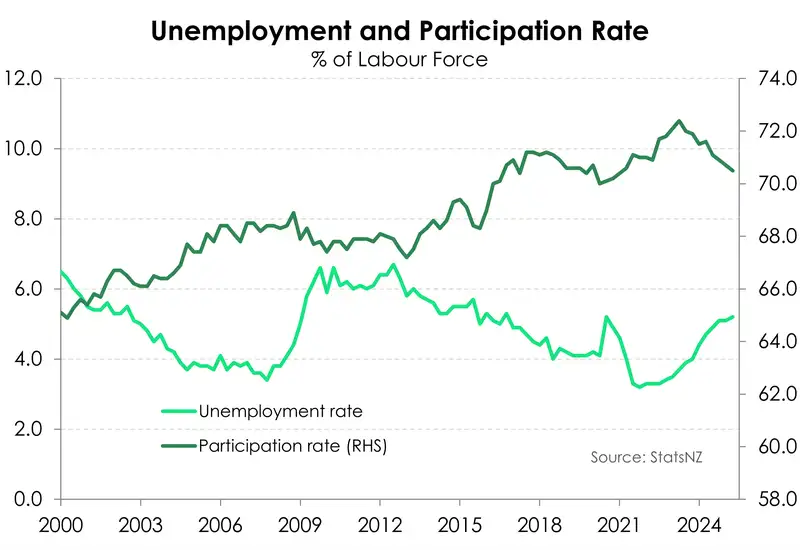

- The Kiwi unemployment rate rose to 5.2% from 5.1%. It would have been higher if not for the steeper-than-expected slide in the participation rate. People are leaving the labour market, and it’s keeping a lid on the unemployment rate. That in itself is a sign of a weak labour market.

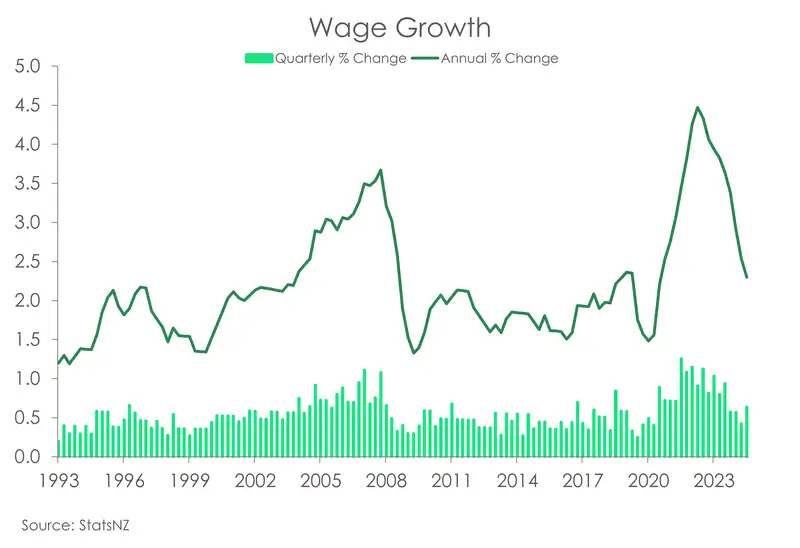

- The moderation in wage inflation continued. Annual wage growth slowed to 2.3%, down from 2.5% - the weakest in four years. Weaker wage inflation is helping to drive further easing in domestic inflation. It’s that famous Phillips curve.

- Today’s data reinforces the need for further monetary policy easing. Downside risks to medium-term inflation are growing given the soft labour market and dimming global outlook. We expect the RBNZ to cut the cash rate by 25bps at the August meeting. And they’ll need to go to 2.5% eventually.

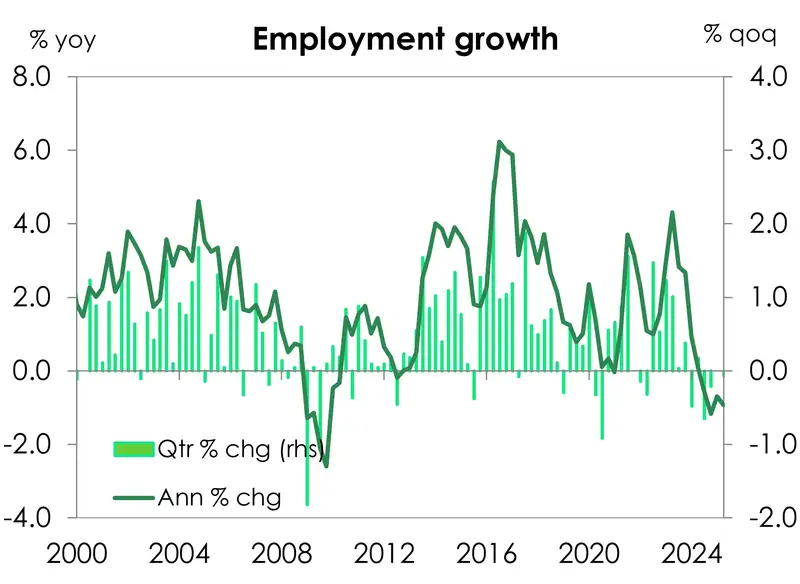

At first glance, today’s employment report looked a bit better than expected, but it wasn’t. The unemployment rate came in at 5.2%, slightly below our forecast of 5.3%. It’s the big drop in labour force participation that’s keeping a lid on the unemployment rate. From (a downwardly revised) 70.7% to 70.5%, the participation rate has dropped to a four-year low. That in itself is a sign of a weak labour market. People are leaving the labour market because it is simply not as attractive as it once was. In fact, the labour force shrank over the year. That doesn’t happen often. The 0.4% decline is the deepest since March 2013. Labour demand is soft. The June quarter recorded a 0.1% decline in employment. And the 0.1% gain in the March quarter was revised to flat. On an annual basis, employment growth is running at the weakest rates since the GFC.

The underutilisation rate – a broader measure of untapped labour market capacity – rose to 12.8%, the highest since September 2020. There’s clearly significant slack within the Kiwi labour market.

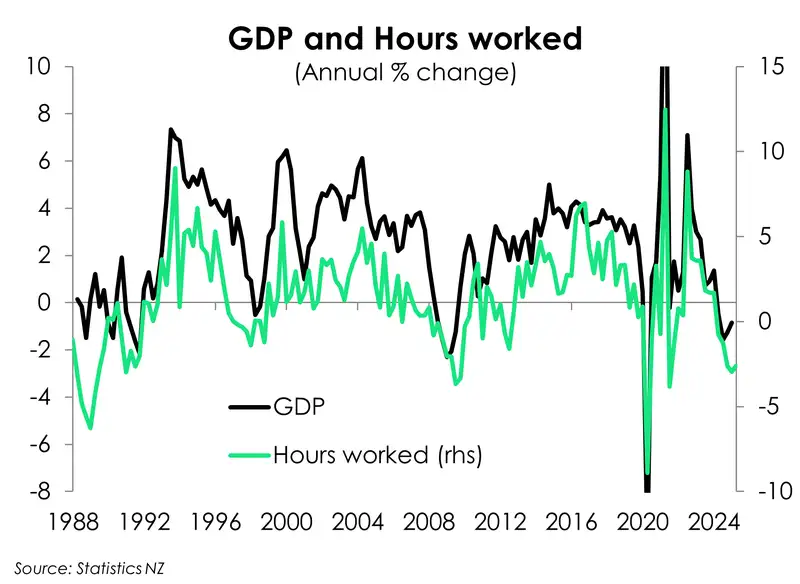

Hours worked fell 1% over the quarter, marking the sixth straight quarterly decline. That’s a concern for how June quarter GDP might unfold. High frequency economic indicators have already been flagging a marked slowdown, potentially a contraction, in activity. This statistic adds to the list.

Declining hours is being met with easing wage pressures. More and more workers are receiving smaller and smaller pay rises. For example, the number of workers receiving a pay rise above 2% but below 3% has been steadily increasing for the last two years. And the wage bill (private sector Labour Cost Index) rose 2.3% over the year – the lowest in four years. That’s quite the drop from the 4.5% peak. That’s indicative of a weak economy.

Overall, today’s report presents a weaker labour market than the RBNZ had expected back in May. The unemployment rate may have been in line with their forecast, but only because of a deeper slide in the participation rate. Labour demand is clearly weaker than the 0.2% gain the RBNZ had forecast in May. The door remains open for a 25bps rate cut later this month. And the cash rate will need to go to 2.5%, eventually.

Labour demand is lacking

While employment growth appeared to stabilise earlier in the year, the June quarter marked a return to decline with employment contracting by 0.1%. Meanwhile, when compared to this time last year employment levels are down 0.9%. It comes with no surprise given the weak undercurrents of the Kiwi economy and the yet to be seen economic recovery.

Delving into the details of declining employment, it’s the full-time workforce that continues to shrink the fastest. Over the last year, the number of people in full-time employment has fallen by 33k as the workforce has shrunk by 1.4%. Meanwhile growth in part time employment has also started to show some cracks. Over the quarter, part-time employment contracted by 1.5%. Still, over the year the part time workforce has managed to expand by nearly 1%.

The concentration of job losses continues to tilt towards a younger demographic. Of the 48.6k total jobs loses over the year, nearly 30% were among those aged 15–24. Ungrouping the high school leavers from the uni grads, it was the high school leavers which saw the biggest job losses with a total loss of 13.5k jobs over the year. Given the challenging labour market conditions for the youth of today, it’s no surprise we saw the number of young people (aged 15-24) in education increase by 5% over the year. Stats NZ report that the annual increase of youth in education came primarily from those not in the labour force. But the rise still portrays the challenges of a weakening labour market.

Weak wage inflation

Growing slack in the labour market and a slowdown in inflation has shifted the balance of power back to employers. The shift is shown by the continued cooling in wage costs. The costly combo of high inflation and labour shortages lit a fire under wage growth, with the private labour cost index (LCI) hitting a series-high of 4.5%. Two years later, that fire has been put out, with the LCI falling to 2.3% - the lowest in four years. The distribution of annual wage growth also underscored cooling wage pressures. The proportion receiving no change in pay has been increasing since March last year, from 33% to 43%. And the proportion of jobs that received a pay rise dropped to 57%, significantly smaller than the 65% share last year. And the distribution of wage increases continues to move away from the chunky increases of more than 5% which was once the favoured rate. That proportion rose to a high of 40% in 2023, and has fallen to just 12% today. Majority are pocketing increases of between 3% and 5%. And now that that inflation has corrected lower, the proportion receiving wage increases of more than 2% but less than 3% has been steadily increasing, from 6% in March 2023 to 13% in June 2025. It’s yet another clear sign of softening employment demand.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.