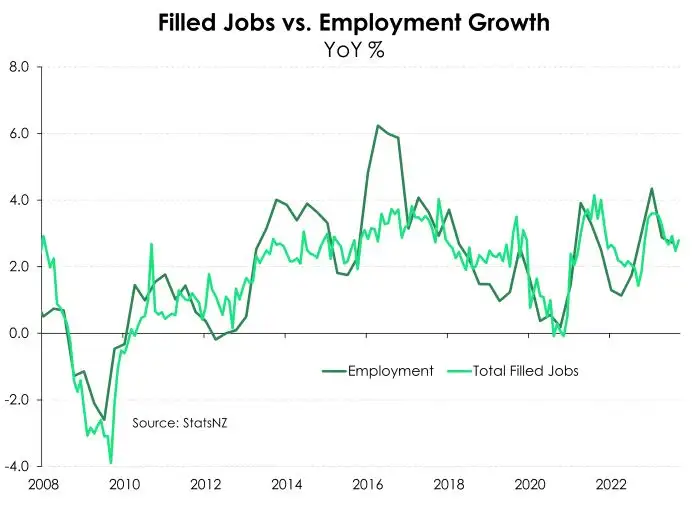

The recent rise in unemployment has largely been a consequence of a migration-led expansion of the labour force. Employment growth remained strong, albeit not strong enough to keep pace with growth in labour supply. But as expected, there has been a shift in the narrative. Employment growth is losing its shine and is becoming the main driver of slack in the labour market. Stats NZ’s monthly employment indicators are now showing declines in the number of jobs. Over the June quarter, monthly filled jobs (seasonally adjusted) averaged a 0.2% decline. June’s 0.1% decline marked the third straight month of a fall in the number of filled jobs. It’s the first time since the 2008 GFC that the data has recorded three consecutive monthly falls. The conceptual differences between Stats NZ’s filled jobs data and Household Labour Force Survey (released on Wednesday) must be noted, with the former being drawn from tax data. Nonetheless, we have pencilled in a 0.3% quarterly decline in employment, following Q1’s 0.2% dip. Compared to a year ago, we see annual employment contracting 0.1%, down from a 1.3% annual gain.

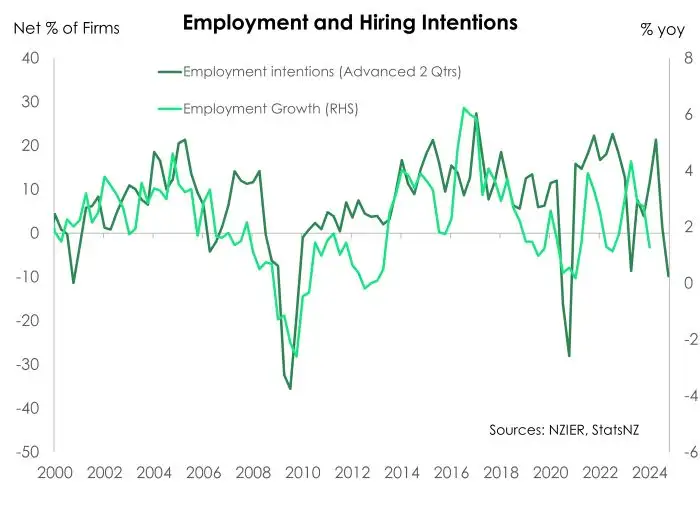

The slowdown in hiring is consistent with the deterioration in labour demand as the economy weakens. Firms simply do not need workers with the same desperation as years past. And NZIER’s June quarter business survey showed similar sentiment. There has been a clear mindset shift among businesses – from increasing headcount to reducing headcount. A net 25% of firms reduced their workforce over the quarter, a big increase from Q1’s net 11%. And a net 10% of firms are looking to do the same in the coming months. It’s just another ugly statistic reminiscent of the 2008 GFC. There are clear signs that the RBNZ’s heavy handed hikes are inhibiting household demand, and hurting business. If firms expect to pump out less output, then an extra pair of hands may prove too costly. We expect employment growth to weaken further in the coming quarters.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.