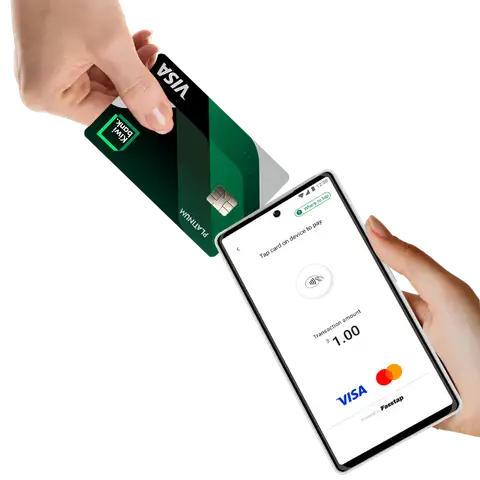

Get paid on the spot with just your phone

-

Take payments anywhere, anytime with your eligible iPhone or Android smartphone or tablet — no need for other terminals or hardware.

-

Easily and securely accept contactless Visa, Mastercard®, Direct Pay, and mobile wallet payments.

-

Set up payment features like tipping, email receipts and refunds to suit your business.

-

Stay in control by adding users, viewing and tracking sales history.

How it works

-

Apply & get set up

Complete the application form. Once you receive a confirmation email, you're ready to download the app from the App Store or Google Play. Follow our easy step-by-step guides to get started.

-

Add users in the merchant portal

Using the merchant portal, accessible via the app and on desktop, admin users can add themselves and others as mobile users to take payments.

-

Accept contactless payments

Your customers can pay your business using their contactless card or mobile wallet with just a tap on your smartphone or tablet. If the amount exceeds $200, a PIN will be required.

-

Accept Direct Pay account to account payments

QuickPay+ generates a QR code for your customer to scan with their smartphone, directing them to their participating bank's app where they can securely approve the payment — no card needed.

-

Use as a primary or secondary payment option

As well as being a great primary payment option, you can use QuickPay+ as a secondary payment option for when you or your staff need to take payments anywhere, anytime.

Eligibility

You need to be a New Zealand resident, 18 years or older. Your company needs to be registered in New Zealand. You'll also need a Business Edge account. A credit check will be carried out as part of your application.

Compatible devices

iPhone |

|

Android smartphone or tablet |

|

*For iOS, requirements are set by Apple and are subject to change.

**NFC is the wireless technology that enables contactless payments.

Fees

Set up fee |

$49 |

Monthly user fee |

$20 per month (for up to two users) |

Additional user fee |

$15 per additional user, per month |

Merchant service fee |

A monthly merchant service fee will apply where you accept Visa and Mastercard transactions. The fee includes the actual interchange1 costs applicable for each type of Mastercard and Visa transaction, plus a card acceptance fee.2 Pay no interchange fees on Direct Pay payments. |

1 Interchange is the fee that Kiwibank pays to the issuing bank of the credit card for the transactions accepted at the merchant’s facility. This is a variable fee depending on the nature of the transaction, card type and processing environment for the transaction. For further detail about interchange rates, visit the Mastercard or Visa website.

2 The card acceptance fee covers other Kiwibank charges associated with processing each Visa and Mastercard transaction.

Tap to Pay on iPhone with QuickPay+

With Tap to Pay on iPhone and QuickPay+, you can accept all types of in-person, contactless payments on your iPhone — no extra terminals or hardware needed.

Apply & get started

Contact us

Enquire online or call our merchant services team on 0800 233 824, Monday to Friday, 8 am – 4.30 pm

Enquire onlineOther payment solutions you may be interested in

Standard terms and conditions

Kiwibank QuickPay+ terms and conditions and eligibility criteria apply. Subject to credit criteria, Kiwibank approval, and merchant services terms including the Kiwibank Merchant Agreement. Kiwibank QuickPay+ is only available for business banking purposes.

The monthly user fee and additional user fee are charged from the month you sign up and are charged in arrears (the following month). If you cancel your facility mid-month, the monthly user fee will still apply for that month.

The Merchant service fees will be calculated monthly at the end of each calendar month, and are payable by you on the 15th of the subsequent calendar month. Should the 15th of the month fall on a day which is not a banking day, the fees will be payable on the next banking day.

A minimum Merchant service fee of $20 will apply for any month that has at least one Visa/Mastercard transaction. This includes Contactless payments, e.g. payWave or PayPass. A month that has no Visa or Mastercard transactions will not be charged a minimum merchant service fee. Mastercard is a registered trademark of Mastercard International Incorporated.

Funds will be paid into your bank account on the next day. See the Kiwibank Merchant Agreement for details.