Invest in moving your business forward

-

Secure your loan against the asset you're purchasing to access funding without needing extra collateral.

-

Choose fixed or variable rates to suit your budget, flexbile terms from 12 months to 5 years, and tailor repayments to your cashflow.

-

Use and own the asset immediately so your business can keep moving forward.

-

Use fleet and multi-asset facilities to simplify complex financing.

How it works

-

What you can borrow for

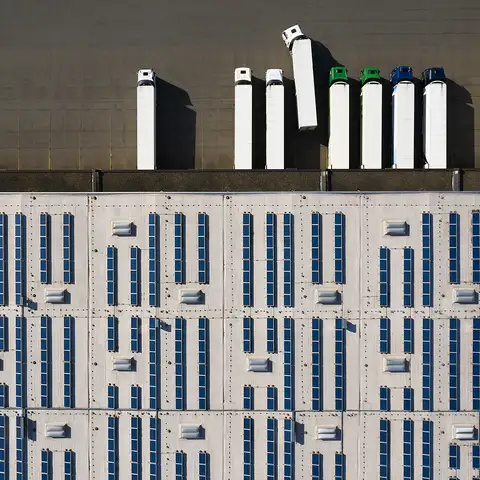

Borrow for tangible assets, including: earthmoving and contracting equipment, business motor vehicles, plant and machinery, fleet finance, commercial trucks and trailers.

-

How much you can borrow

Depending on your circumstances, you can borrow up to 100% of the purchase price of a new asset, with lending starting from $20,000. GST can be funded.

-

Security

Your loan will be secured by the asset you're buying, or against your existing plant and equipment, if additional security is required. You'll have ownership and use of the asset while you're paying it off.

-

Interest rates

Your interest rate will depend on the terms of your loan, the security you have to offer, and the circumstances of your business.

Your asset finance options

Term loans |

|

KiwiLink |

|

KiwiPlus |

|

Apply for asset finance

Get in touch with us to talk through the asset finance options that might best suit your business.

Have a Xero or MYOB account?

If you're a director of a New Zealand registered company and use Xero or MYOB Business (Lite, Pro or AccountRight), you may be able to apply online and get a decision in minutes.

Apply nowTalk to a business banking specialist

Talk to one of our business banking specialists. They’ll let you know what you need to do and what your options are.

Talk to usOther borrowing options you may be interested in

Depositor protection

The Depositor Compensation Scheme (DCS) came into effect on 1 July 2025. Find out more.

Kiwibank's eligibility criteria, lending criteria, terms and conditions, and fees apply.