The RBNZ have effectively cut financial conditions via lower market interest rates and exchange rates.

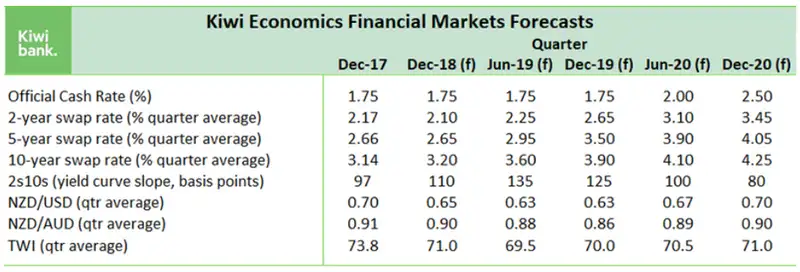

Last week, we adjusted our rates forecast, and cut our currency forecast. We now see the bird hitting 63c in 2019, previously 67c. And the 2-year swap rate will trade in a lower range too.

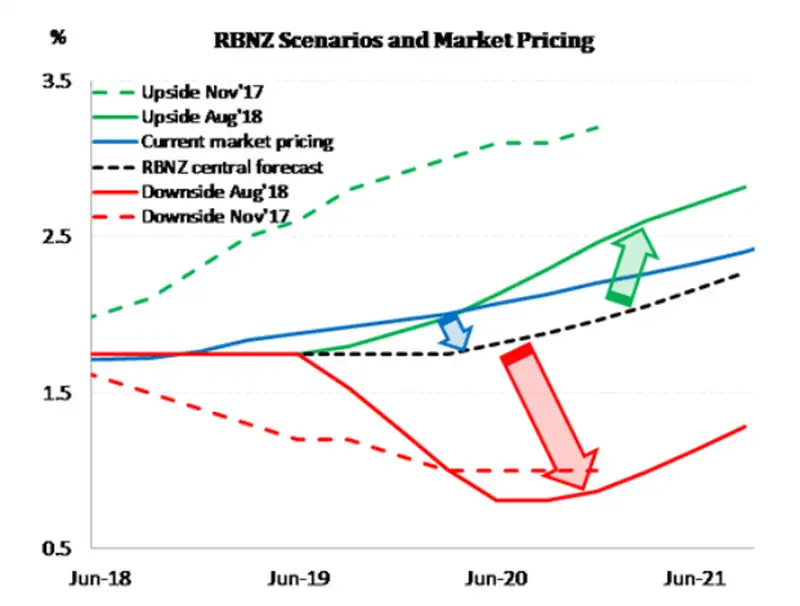

The RBNZ slashed their OCR track last week and presented uneven risks. The central bank has shown asymmetry in probabilities, and the local rates market has repriced lower for longer still. Firm forward guidance has been an effective tool for central banks to guide pricing in markets, and reduce volatility. The risks facing the Kiwi economy have soured a little, so the RBNZ has eased conditions a little. The bar has been lowered.

The RBNZ’s statement was clever. Not much change was expected in the statement. The hedge fund community had large positions into the belly of the Kiwi yield curve (out to 5-7 years). So the ‘surprisingly dovish’ tilt of the RBNZ drove a large reaction, as hedge funds were forced into action. The 5-to-7year part of the Kiwi interest rate curve gapped lower. The “Shock and Orr” statement put the Kiwi on the endangered currency list also. And here we are with lower swap rates and exchange rates. Mortgage rates are now more likely to be lowered than lifted, because of lower wholesale swap rates. And farmgate prices and tourism flows are likely to be healthier, because of a weaker Kiwi dollar. Lower interest and exchange rates have effectively reduced the chance of rate cuts. But rate cuts are a risk we must play. We now have lower ranges and should see steeper curves. That’s clever.

Here are some thoughts from the front line

The interest rate market has been flushed out

“A huge reaction to the RBNZ meeting, showing that positioning into the meeting was either lighter than expected and/or the market had it completely wrong and ran for the exit door. Suggest it was a little of both.

The fierce rally has jolted the benchmark 2-year swap rate into a new 1.95-2.10% range, however with mortgage books/profit takers/and cross market payers all lurking around 2.00% expect a small bounce in the short term.Ross Weston, Head of Kiwibank Trading

Compounding up the latest RBNZ OCR forecasts assumes a 2-year swap rate of around 1.95% which loosely ties into the previous lows, of course that assumes funding levels remain around the current very tight levels, which is unlikely to be true forever. The curve shape flattened via mid curve receiving, even though logic dictates a delay to the RBNZ the curve should have steepened, there may be some element of no rate hike logic creeping in here. Regardless, medium term it feels with an anchored short-end the curve could steepen in the 5-10year sector as a result of a more favourable offshore yields vs. our own.” Ross Weston, Head of Kiwibank Trading

The Kiwi currency was technically wiped out

“With all technical support zones wiped out on the Kiwi post RBNZ we are in a nervous period where we need to set a new trading range. That range looks set to bottom at $0.6500 with topside residing around $0.6700 (or the previous lows pre RBNZ). Long term the direction will be moulded by international trade outcomes, a more conciliatory outcome will see the NZD rise while a further escalation or implementation of the $200b US tariff against Chinese goods will spell further NZD downside.

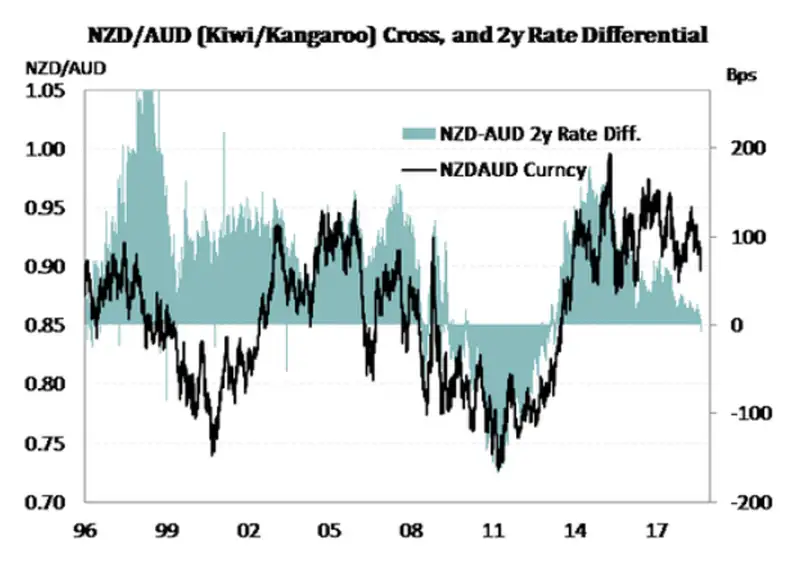

The NZD/AUD cross has melted lower post RBNZ meeting, with the RBA meeting two days prior in which they sounded more optimistic the cross has fallen through the $0.9100 support zone, only to partially recover on emerging markets/trade concerns.Ross Weston, Head of Kiwibank Trading

The market remains very short NZD, the NZD is no longer a buy because of its high yielding status, in fact quite the opposite which is why positioning has swung to extremely short. This means that rallies from here are likely to be sold into particularly while the RBNZ remains so incredibly dovish.” Ross Weston, Head of Kiwibank Trading

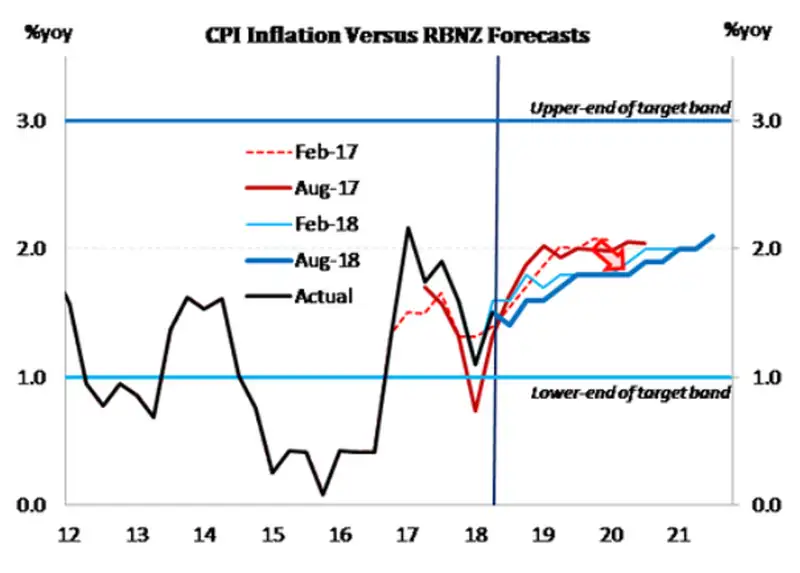

Inflation is harder to generate in the post crisis world

The evolution of, or disappointment in, the RBNZ’s inflation forecasts tell the tale. Over the last ten years inflation has predominantly surprised on the low side. Officials often speak to the weakness in tradable inflation – prices for the stuff we import. We’ve effectively imported deflation for 5 years. Inflation has disappointed, globally. And Phillips’ curves have flattened, and even inverted in parts. Most central banks are inflation targetters. And most central banks have struggled to meet the inflation part of their mandate. Monetary policy remains accommodative globally.

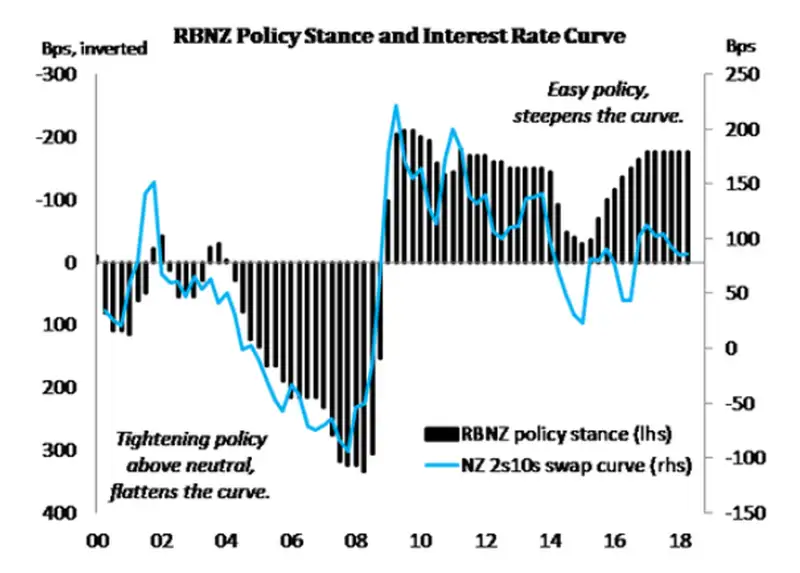

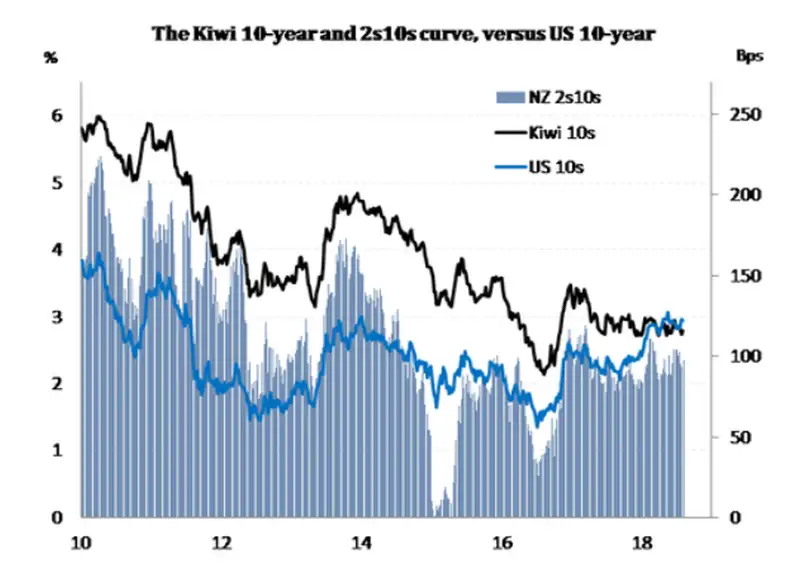

The RBNZ have prescribed what they deem to be very accommodative settings. They’ve cut the cash rate 175bps below the level they deem neutral (3.5%). Even if neutral turns out to be closer to 3%, as we suspect, policy is still easy. Easy policy normally induces growth. And easy policy normally induces steeper yield curves. But like all developed market curves, the long end of our curve (5-10-year interest rates) is set off global benchmarks – namely US interest rates. So, we need global yields to rise for our long-end yields to rise.

The world is currently grappling with the idea of global trade wars, emerging market crises (as monetary stimulus is drained), high levels of debt (especially in Asia), and a general cooling in economic momentum. Interest rates are struggling to lift. But we expect interest rates to lift from here. The US Federal Reserve (Fed) are moving, gradually, to normalise policy. The Bank of England (BoE) have hiked off the floor. The European Central Bank (ECB) are planning on stopping QE (printing money). And the Peoples’ Bank of China (PBoC) are doing what it takes to elongate China’s business cycle. That’s good news for us. The more the Fed lifts, the more global rates can lift, the lower our currency might be. And the RBNZ know it.

We forecast a lower for longer curve and a flightless bird

We revised our interest rate forecast lower. Because the new RBNZ Governor has shown a desire to stimulate until proven effective. We believe Governor Orr is more willing to allow inflation to run above the 2% mid-point for a period. And we agree. We have argued for a relaxation in the rigidity of inflation targeting. Inflation has run below target for too long. Let inflation run a little above for a short period. We have discovered inflation to be a difficult beast to resuscitate in the post-crisis, and demographically challenged world. The realisation that the RBNZ Governor is seemingly more willing to let inflation run, led us last week to lower our OCR trajectory. Our 1-to-3 year interest rates forecasts, pegged to expectations for the OCR, were also mechanically lowered.

More importantly, we forecast a steeper yield curve. More stimulatory RBNZ policy will not only hold short-end (1-3 year) rates lower for longer, but stimulate expectations of growth and inflation further out the curve. And hopefully the slow removal of monetary policy stimulus offshore will allow our longer-end rates to lift (at a lesser rate than US rates of course). Our forecast yield curve, expressed as a difference between 2-year and 10-year swap rates, goes from a current level of ~85bps to 135bps next year. Longer dated money may demand a greater return from here. And we should demand more in terms of inflation protection (linkers).

So we have a period of lower for longer interest rates, and hopefully a steeper yield curve as we ratchet up growth and inflation expectations. But what does that mean for the bird?

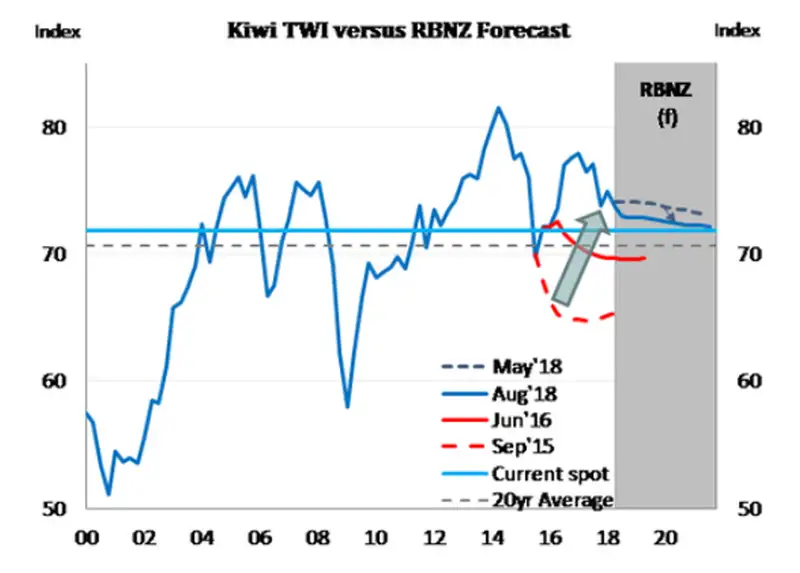

Let’s face it, the RBNZ (along with most central banks) have wanted a weaker currency post-crisis. The RBNZ (along with most forecasters) have generally underestimated the bird’s ability to fly. And here we are with a lower bird, and some traders are crying fowl, sorry foul. Well it’s not that low. Look at the chart. They’ve called it much lower before. And now, for the first time in a long time, the bird is flying below the RBNZ’s forecast track. That’s a nice “problem”, or forecasting error, to have. If the bird remains in a lower for longer flight path, then there’s a good chance we get better than expected economic outcomes. And it’s all about lifting heads. A lower Kiwi boosts export revenues, growth and inflation expectations.

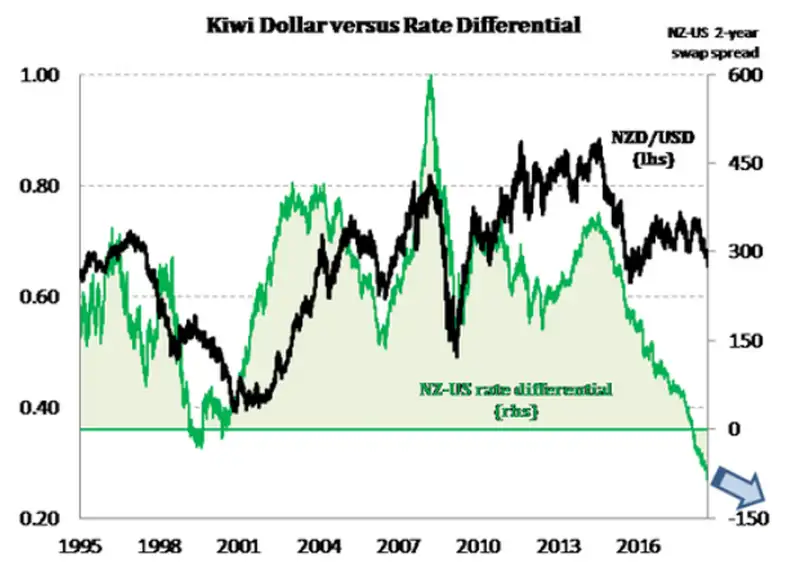

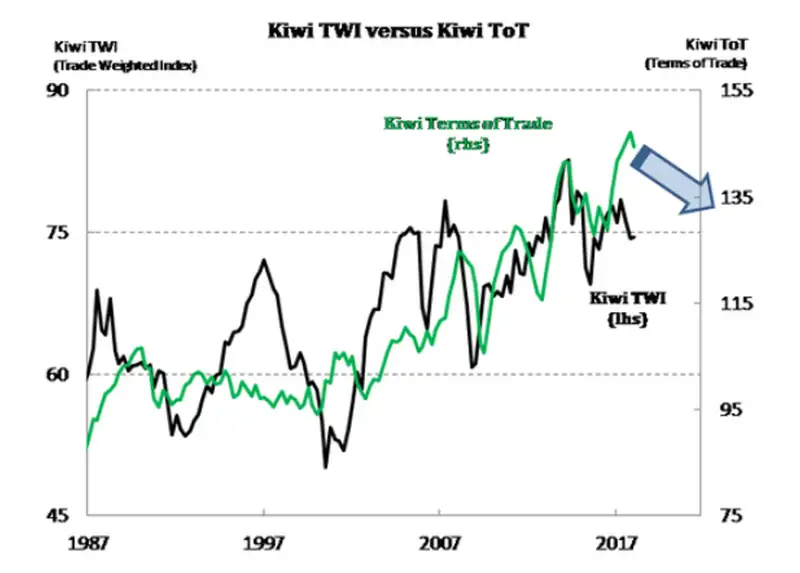

In April, we went through the drivers of the most beautifully volatile currency in the world. Basically, the flying Kiwi has benefitted from the uplift in our terms of trade; and some turbulence, or air pockets, have developed with negative interest rate differentials. Following the RBNZ’s August statement, our forecast interest rate differentials favour an even weaker currency. So we lowered our currency forecasts.

At the time of writing our last currency outlook, the Kiwi flyer was ~$0.7250. We predicted a mild depreciation to 0.67c in 2019, noting it’s “Not a large move, but it’s a move in the right direction.” The move to 67c occurred a lot faster than we expected. We have a more assertive RBNZ Governor, and a slightly weaker than expected economic backdrop. Going through the tea leaves, we now see the Kiwi gliding a little lower to 63c next year. Again, we don’t see this as a big move, but the right move.

For those trading with the sandpaper wielding underarm bowlers, well, we’re on sale. The Kiwi/Kangaroo cross (NZD/AUD) has fallen from ~$0.9450 in mid-April to ~$0.9060 today. In April we said “We see the NZD/AUD easing towards 90c, and possibly 87c over the same period (2019)”. We believe we’re bang on here. We leave our NZD/AUD forecast unchanged. Australia faces similar forces, but greater issues in housing. So we are unlikely to depreciate too much more against the big red dust bowl.

All content is general commentary, research and information only and isn’t financial or investment advice. This information doesn’t take into account your objectives, financial situation or needs, and its contents shouldn’t be relied on or used as a basis for entering into any products described in it. The views expressed are those of the authors and are based on information reasonably believed but not warranted to be or remain correct. Any views or information, while given in good faith, aren’t necessarily the views of Kiwibank Limited and are given with an express disclaimer of responsibility. Except where contrary to law, Kiwibank and its related entities aren’t liable for the information and no right of action shall arise or can be taken against any of the authors, Kiwibank Limited or its employees either directly or indirectly as a result of any views expressed from this information.