Mobile app

If you'd like to open a Term Deposit for $1m and over, complete our form.

If you'd like to invest over $1,000 and under $1m, you can do this in the mobile app by following the steps below. PIE Term Deposits are required to have a minimum deposit balance of $10,000.

-

1 / 3

Select investment

- Log in to the mobile app.

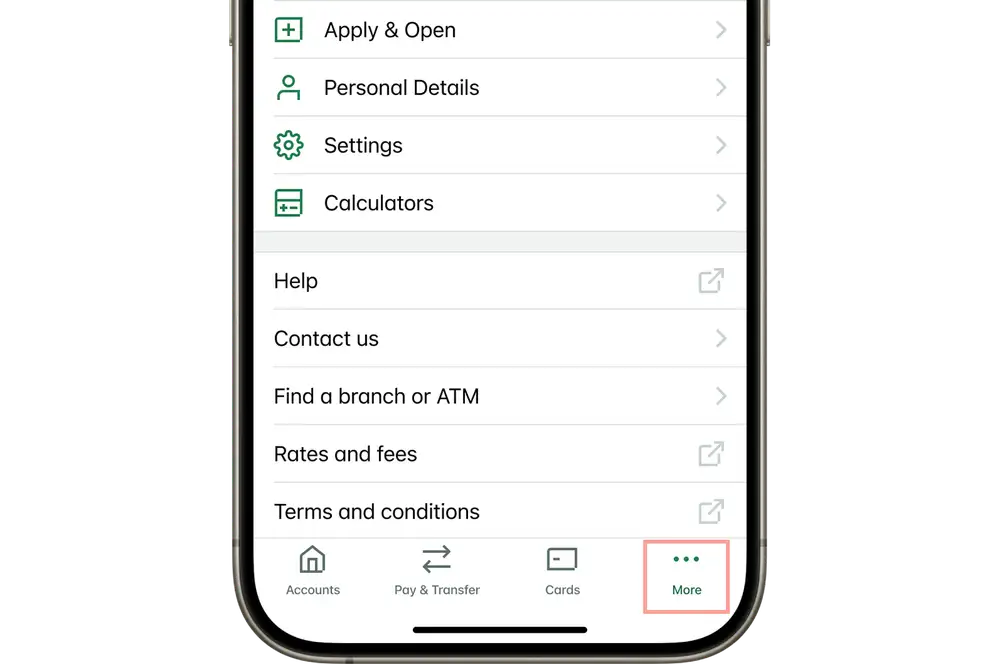

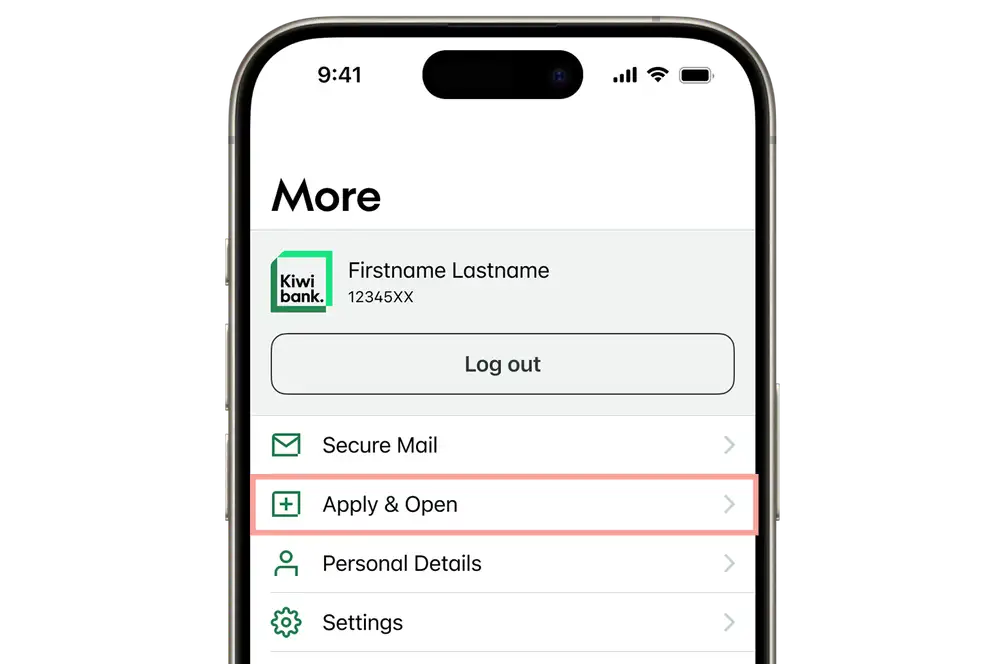

- Tap 'More' at the bottom of the screen.

- Select 'Apply & open'.

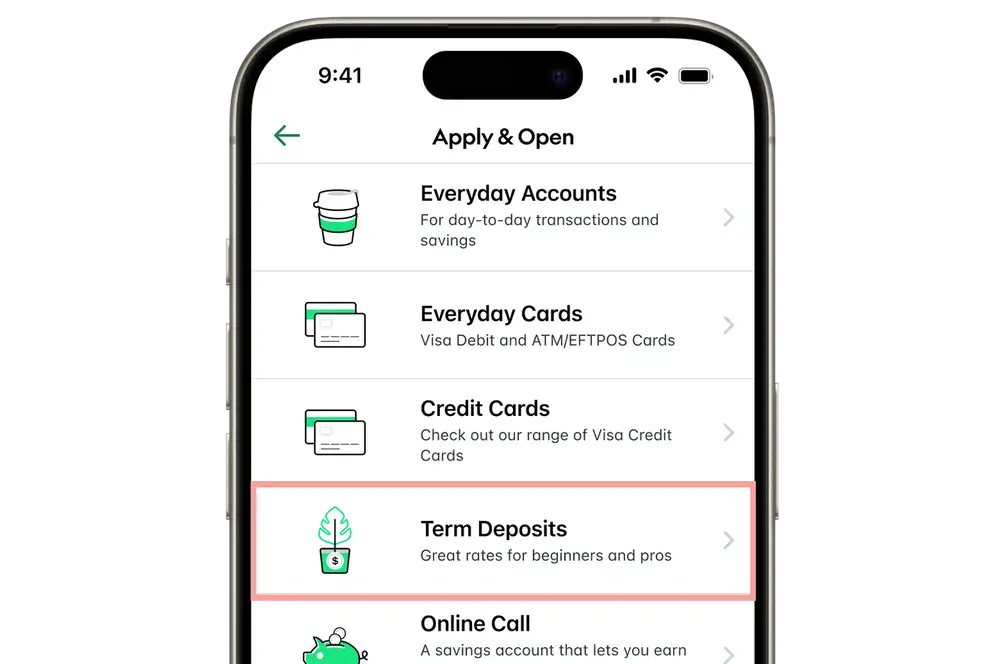

- Tap 'Term deposits'.

-

2 / 3

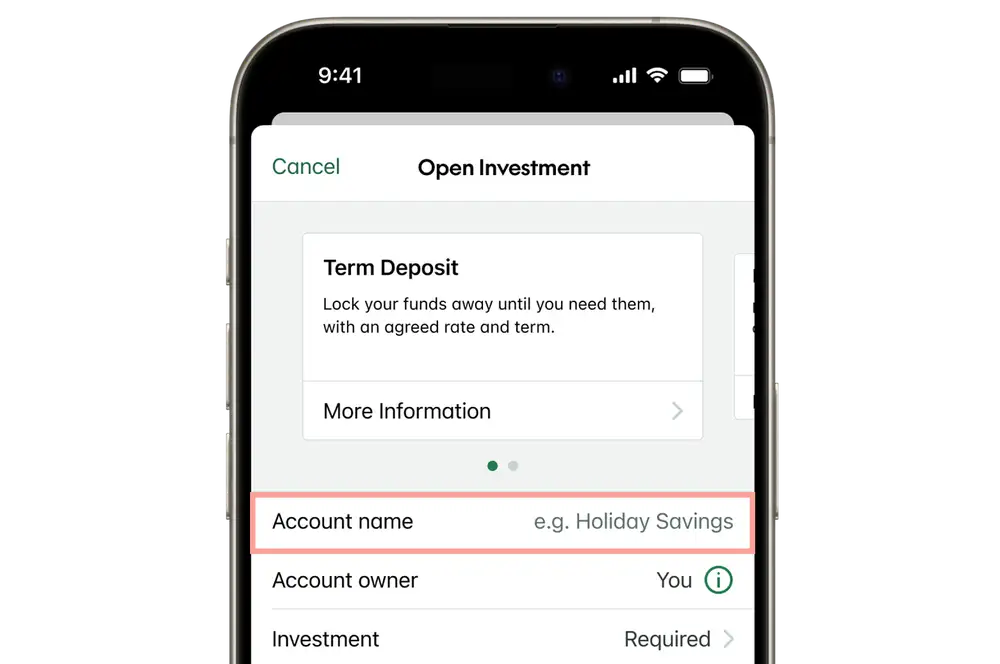

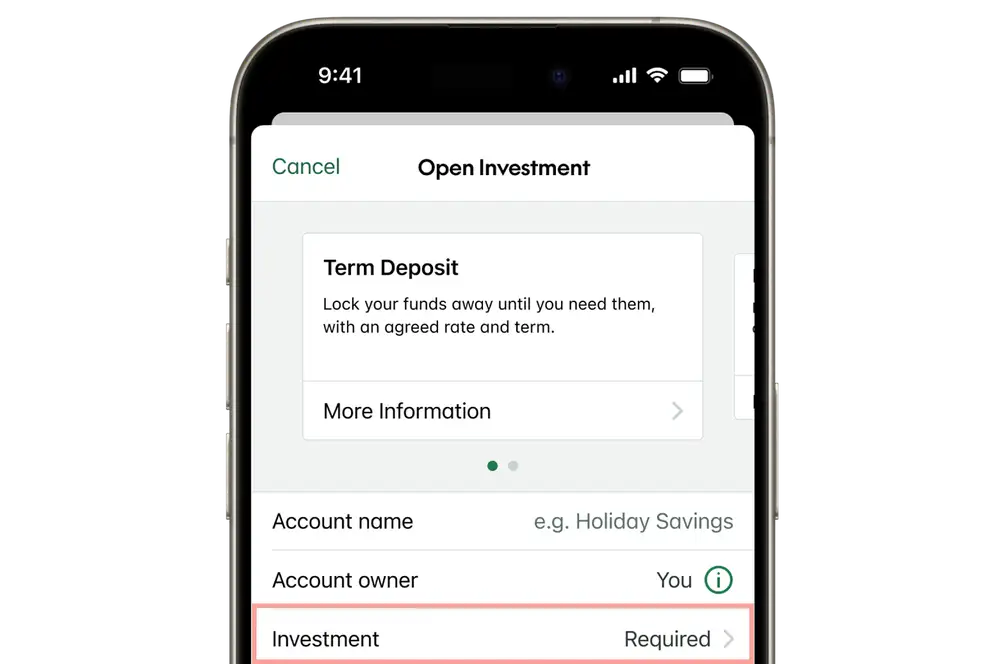

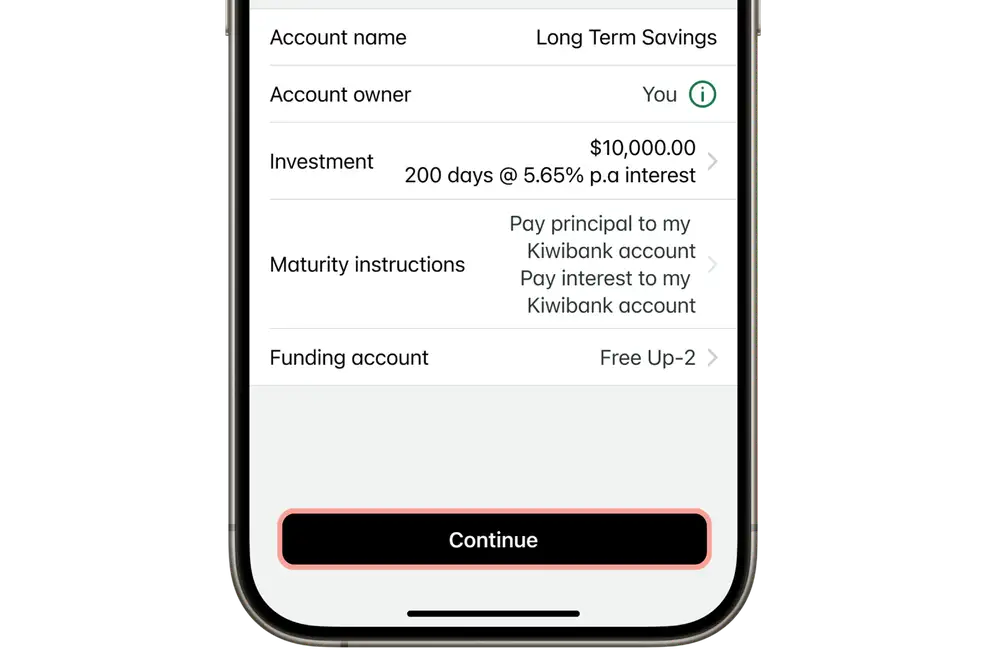

Enter investment details

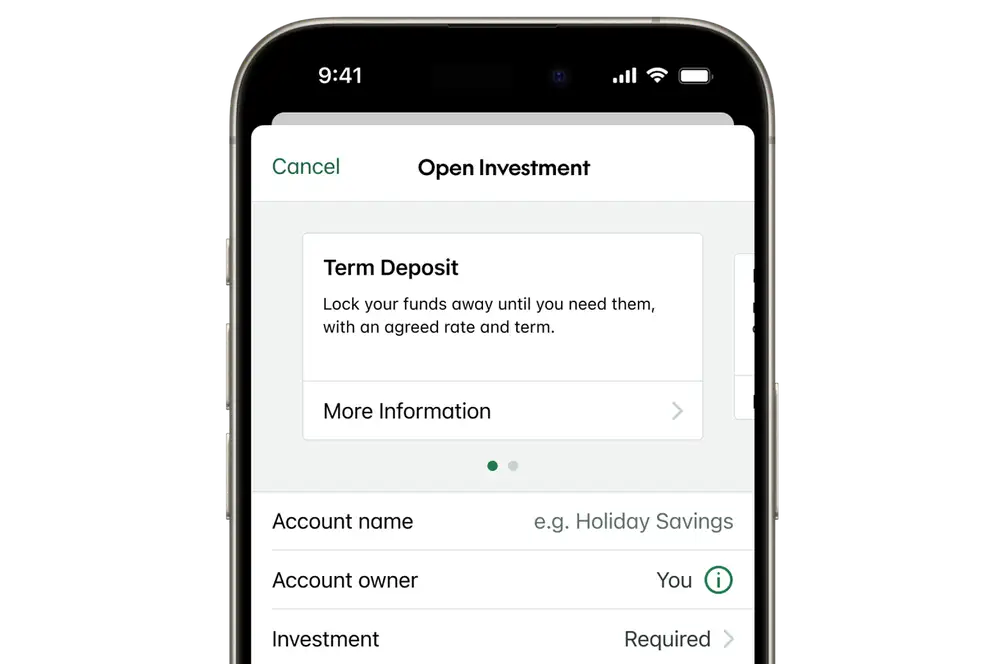

- The investment type defaults to a Term Deposit. Swipe across to open a PIE Term Deposit if you're applying for a PIE investment.

- Enter the 'Account name'.

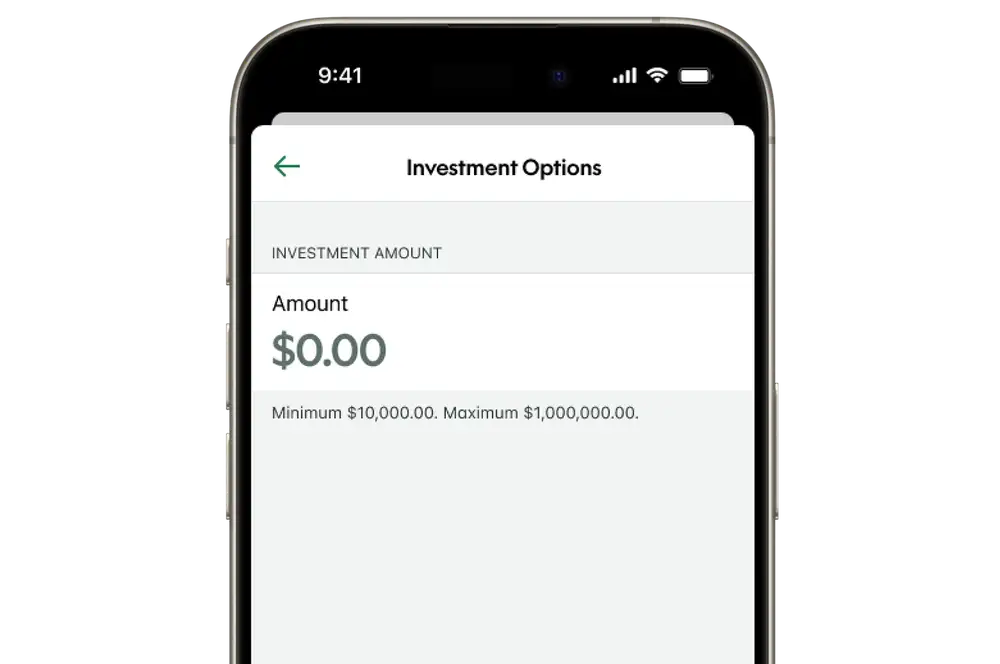

- Tap 'Investment', then enter the investment amount.

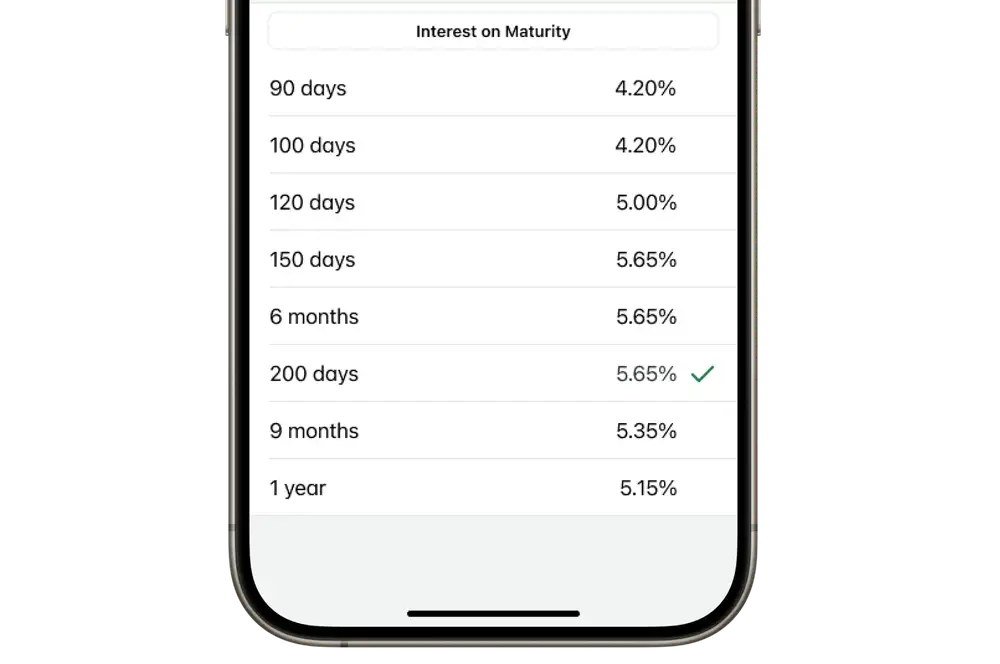

- Select an investment term from the list. The investment term is the fixed amount of time your Term deposit is locked in for.

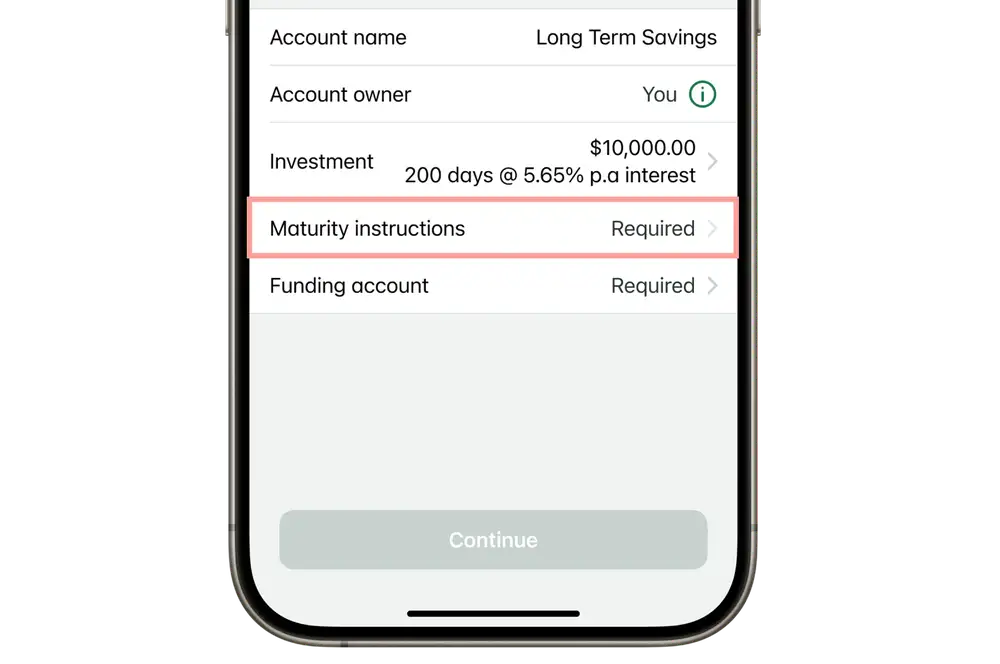

- Tap 'Maturity instructions'. The maturity instructions specifies what happens to your funds when the Term Deposit term ends.

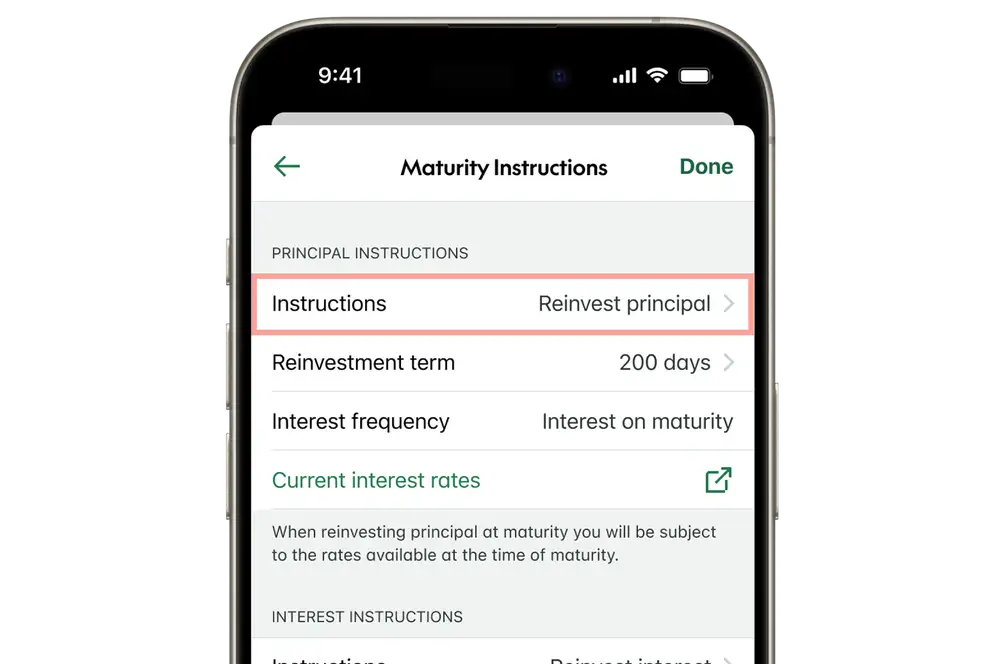

- Under 'Principal instructions', tap 'Instructions', then select whether to pay the principal out or reinvest the principal at the end of the Term Deposit.

- If you select to pay the principal out, then select the account.

- If you select to reinvest the principal, select the reinvestment term.

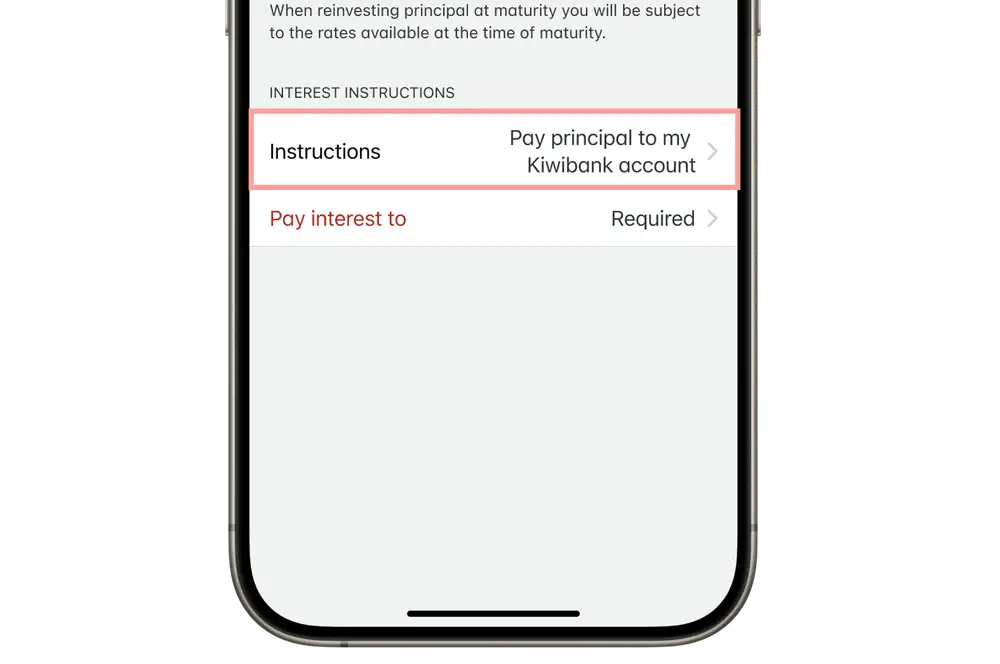

- Under 'Interest instructions', tap 'Instructions', then select where to pay the interest out to, or reinvest if applicable.

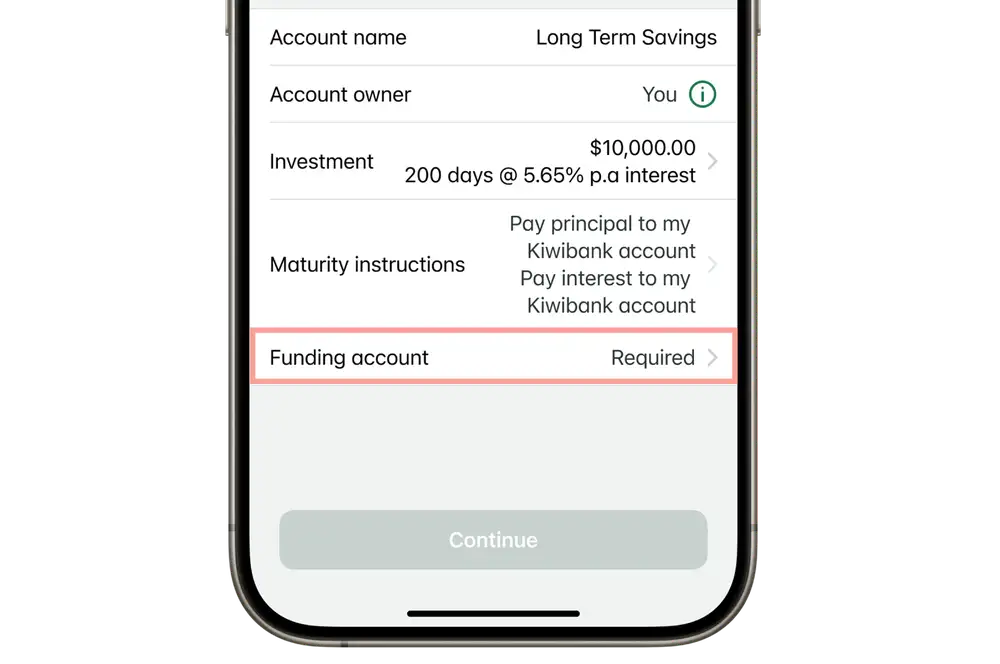

- Tap 'Funding account', then select the account you're using to set up your Term Deposit.

- Tap 'Continue'.

-

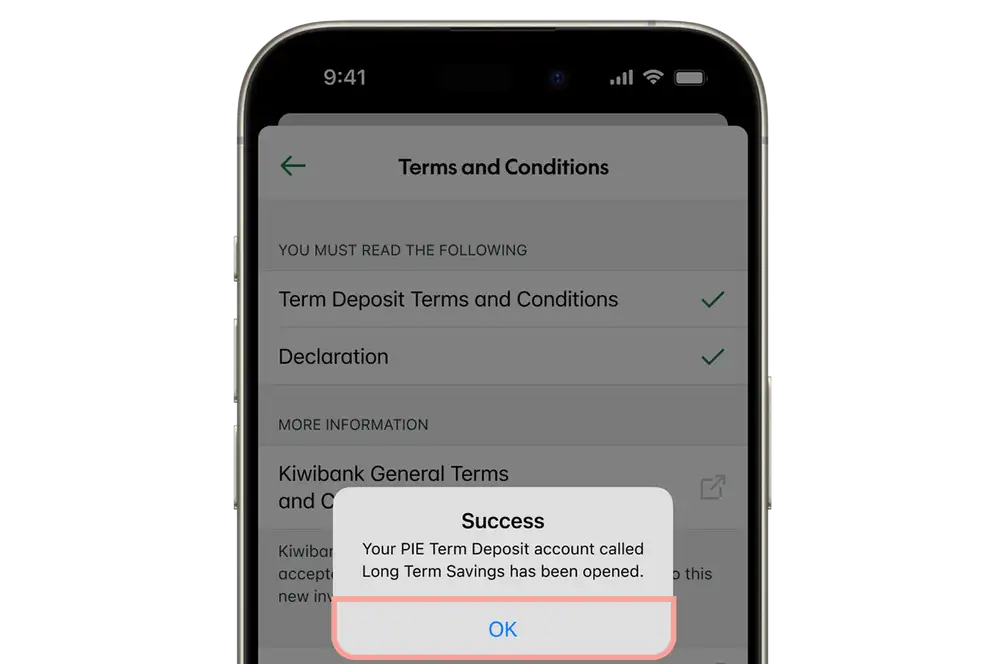

3 / 3

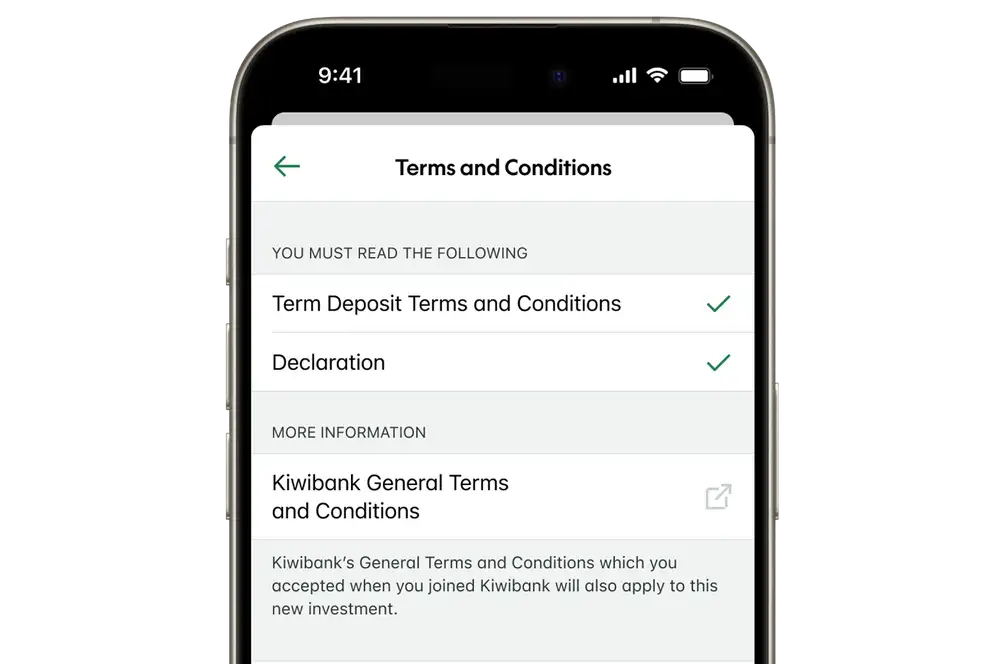

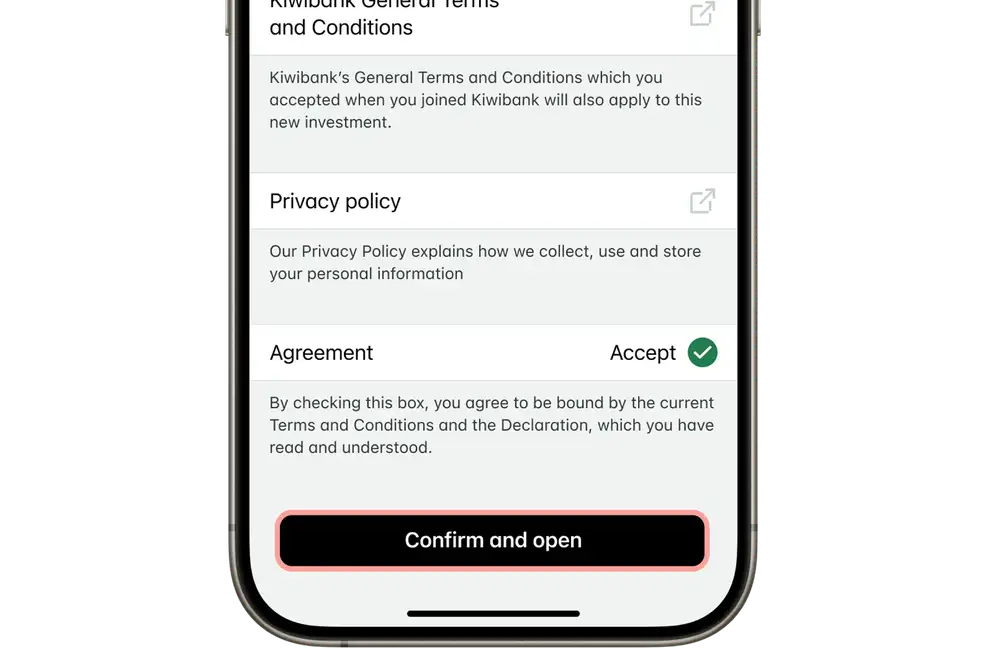

Confirm your application

- Read the terms and conditions and declaration and accept them.

- Tap 'Confirm and open'.

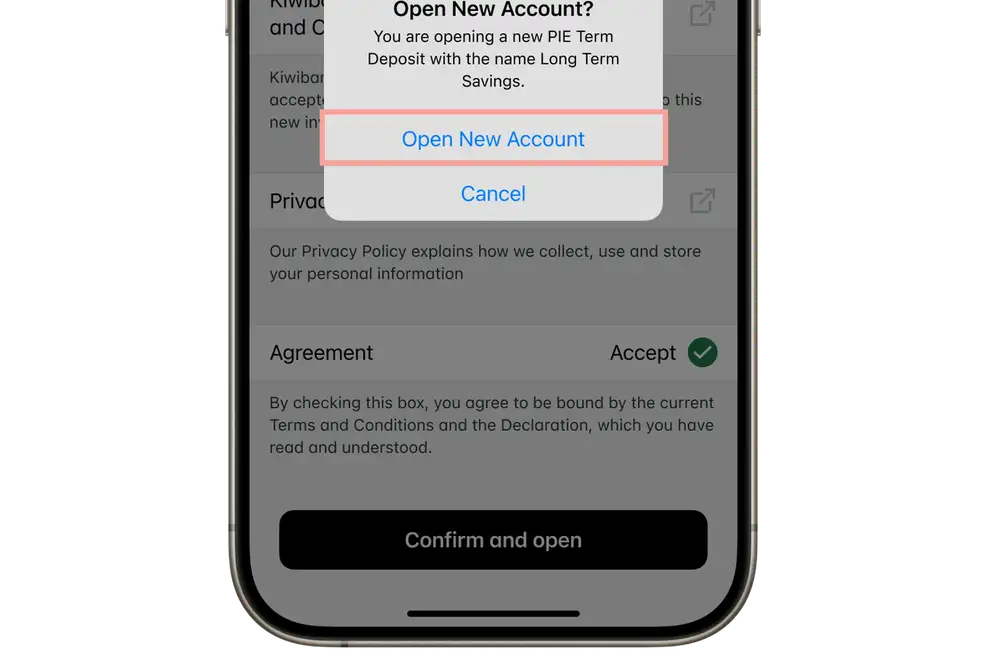

- Select 'Open New Account'.

- Tap 'Ok'.

Internet banking

If you'd like to open a Term Deposit for $1m and over, complete our form.

If you'd like to invest over $1,000 and under $1m, you can do this in internet banking by following the steps below. PIE Term Deposits are required to have a minimum deposit balance of $10,000.

-

1 / 3

Select investment type

- Log in to internet banking.

- Click 'Apply & open' at the top of the screen.

- Select 'Savings & investments'.

- Select 'Term Deposit' or 'PIE Term Deposit' if you're applying for a PIE investment.

- Click 'Next'.

-

2 / 3

Enter investment details

- After you've read the information, click 'Begin the application process'.

- Complete the application form.

- Click 'Next page'.

- Enter the investment amount.

- Select the investment term. The investment term is the fixed amount of time your Term deposit is locked in for.

- Under 'Interest and maturity instructions' select what to do with the principal and interest, and enter any applicable details. The maturity instructions specifies what happens to your funds when the Term Deposit term ends.

- Select the funding account.

- Enter the 'Account title'.

- Click 'Next page'.

-

3 / 3

Complete your application

- Read the application summary and check that the details of the term deposit are correct.

- Read and agree to the declaration.

- Read and agree to the terms and conditions.

- Click 'Open' to create your new term deposit.

New to Kiwibank

New to Kiwibank

Complete our online application form to join Kiwibank. From there you can open a new Term Deposit within the mobile app or internet banking.

Want to talk through options

Complete our form and an investment specialist will call you to talk through the different investment options.

Standard terms and conditions

Kiwibank PIE Online Call Fund, Kiwibank PIE Term Deposit Fund and Kiwibank Notice Saver are funds within a Portfolio Investment Entity (PIE). Units in Kiwibank PIE Online Call Fund, Kiwibank PIE Term Deposit Fund and Kiwibank Notice Saver are distributed by Kiwibank Limited and are issued by Kiwibank Investment Management Limited.

Download all investment terms and conditions or pick up copies from your nearest Kiwibank.