24/7 transaction monitoring

Our dedicated customer protection team monitors transactions and card activity around the clock — 24 hours a day, every day of the year.

If we notice unusual spending on your card or account, we may send you a text or email to check if you authorised the transaction. If we can't reach you and believe there's a high chance of fraud, we may temporarily block your card to stop further transactions until we speak with you.

Even with these measures, fraud can still happen. It’s important to monitor your banking activity and let us know immediately if something doesn’t look right.

Learn more about monitoring and data safety.

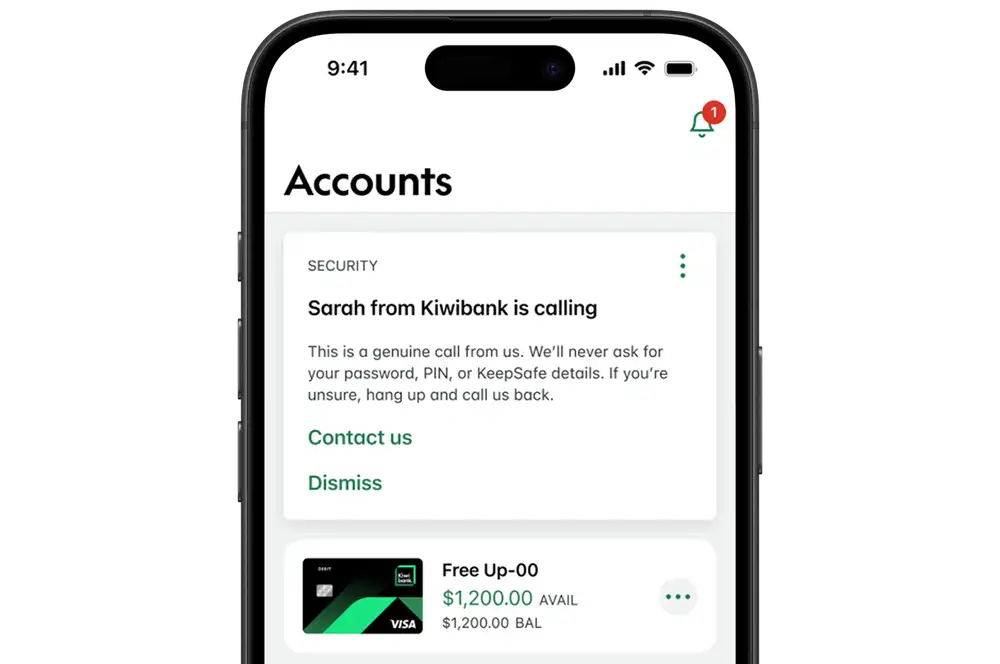

Call verification

When we call you, you may get a notification in the mobile app or internet banking. This helps us keep you safe from impersonation scams, so you'll know:

- you're talking to a genuine Kiwibank representative

- your accounts are safe

- you can trust the conversation.

If someone calls you and cannot verify they're a Kiwibank representative, hang up immediately and call us on 0800 113 355.

Extra layers of security for your accounts & transactions

Strong passwords help to protect your accounts, but they're not always enough. We've added extra layers of security to double-check it's you logging in or making a transaction in our mobile app or internet banking, like multi-factor authentication (MFA).

This includes:

- biometric login (face ID or fingerprint)

- SMS one-time codes

- 3D Secure (Verified by Visa) for some online card payments.

Safer payment checks

To meet new scam protection commitments under the Code of Banking Practice, we’re adding extra protection to your digital payments. This is to help you — and us — spot scams before money leaves your account.

For some payments, you may be asked for a payment purpose so we can show you the right scam-prevention tips. If something looks unusual, we’ll let you know or, in some cases, decline the payment to keep you safe.

Learn more about how we're making your payments safer.

Confirmation of Payee

Confirmation of Payee checks if the account owner's name matches the account number of the person or business you're paying. This helps make sure you're paying the right person or business and adds an extra layer of protection against scams and fraud.

If the check returns 'Not a match', it's important to verify the payee's details and identity. If you continue with the payment, you may send money to the wrong place, which may not be recoverable.

This service applies to payments between New Zealand banks when using our mobile app or internet banking. It isn't available for international payments, business-to-business transactions, phone payments and in-branch transfers.

Learn more about Confirmation of Payee.

Other online banking features

- Temporary card blocks: If you notice suspicious transactions or misplace your card, you can use the mobile app or internet banking to put a temporary block on cards.

- Locking access to online banking: If your online banking password is entered incorrectly three times, access will be blocked. This prevents anyone from making multiple attempts to guess your password. To unblock your account, you'll need to reset your password.

- No caching on online banking platforms: Other people can't use your computer to view your bank account details by clicking the browser back button.

Digital certificates

We use digital certificates to verify you're connected to our official online banking website. These certificates confirm all communication between you and Kiwibank is encrypted and secure. Encryption is a mathematical method of coding information.

Internet banking guarantee

If you're the victim of unauthorised activity on your accounts within our mobile app or internet banking, we'll reimburse any money you've lost, as long as you haven’t acted dishonestly or negligently and have taken reasonable steps to protect your banking.

Learn more about our internet banking guarantee.

What to do if you've been scammed

Anyone can fall for a scam. If you suspect that you've been scammed, take action immediately.

Take action

If you've been scammed, move quickly. See what steps to take to help reduce the impact.

I've been scammed24/7 support

Fraud and scam support is available around the clock. Call 0800 113 355 or +64 4 473 1133 from overseas.

Call 0800 113 355Protect yourself

Simple actions can significantly improve your online and financial security.

What you can do