Latest scams

Investment scams: Deepfake celebrity & political endorsements

These scams use fake news stories and celebrity endorsement advertisements that have been digitally altered to look like someone else. They are spread through social media, websites and advertisements, to promote online investment schemes.

The names of investment schemes and websites used to promote the scam change frequently. People who invest through these websites are unable to withdraw funds, with scammers requesting additional fees. They may also use aggressive sales techniques to convince people to invest.

Investment scams can be hard to spot but common red flags include:

- claims of guaranteed returns or interest rates that seem too good to be true

- lack of clear contact details

- request forms asking for personal and investment details.

For more information about deepfake video and fake celebrity investment scams, visit the Financial Markets Authority website.

Investment scams: Cryptocurrency

We've observed an increase in cryptocurrency transactions, which is accompanied by a growing number of individuals being targeted by fraudulent cryptocurrency investment schemes, particularly through social media platforms.

These scams often involve misleading offers of high returns or exclusive opportunities, luring users into making investments or sharing personal and financial information.

As the popularity of cryptocurrency continues to rise, it's more important than ever for users to stay alert and cautious, actively recognising and steering clear of misleading practices. See the Financial Markets Authority website for a list of identified fraudulent cryptocurrency platforms.

Online marketplace scams: Non-delivery & phishing

Scammers are listing items that they either don't have or have no intention of selling. They'll send payment instructions, but never send the item.

They're also posing as legitimate buyers or sellers to steal personal information. This information might be used to target you in future scams or for other illegal purposes.

Be suspicious of:

- buyer or seller profiles that look new or incomplete

- requests for personal information

- buyers or sellers who send you links to confirm purchase or postage

- unfamiliar purchasing platforms or websites.

See our online sellers and buyers page for more information.

Card fraud: Stolen card details in mobile wallets (Apple Pay & Google Pay™)

Scammers are using illegally obtained card details to set up cards in mobile wallets. By doing this, they can access funds and hope to avoid detection. If you receive a notification about a new debit or credit card being added to your mobile wallet that you didn’t initiate, contact us immediately. To protect yourself, check your personal details are current so we can send you a text message when a debit or credit card is added to your mobile wallet.

Impersonation scams: Phone calls

We’re seeing a lot of phone scams targeting customers, claiming to be from Kiwibank. These calls can come from 0800, local, private or overseas numbers and ask you for your banking login details, passwords or authentication codes.

We’ll never ask for your passwords, KeepSafe questions and answers, PIN, one-time PIN or card details over the phone. We’ll always verify your identity in other ways to ensure your personal information and accounts are kept safe.

If you're ever unsure whether a call is legitimate, ask for a name or reference number and call us back on 0800 113 355 (or +64 4 473 1133 from overseas).

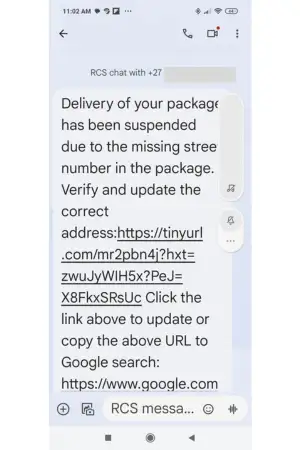

Impersonation scams: Phishing & smishing

We've been seeing a notable increase in text and email phishing scams impersonating Kiwibank, NZTA, NZ Post and IRD.

These texts and emails often look legitimate. They generally include a fraudulent link that will take you to a webpage or form that asks you to input personal or banking details which will be used by scammers.

Example: Kiwibank text scam

This scam appears to be sent from a 'short code' used by telcos, banks, and other legitimate organisations. More information on this scam is available on Own Your Online by CERT NZ.

Example: NZTA impersonation text scam

Example: NZ Post impersonation text scam

Example: IRD impersonation scam

IRD scams are prevalent around the end of the tax year (March and April). IRD will never send website links though text message.

What to do

- Scam text messages: If you receive a text message that you think could be a scam, copy the message and forward it to the Department of Internal Affairs reporting system on 7726 (SPAM).

- Scam emails: Forward suspicious emails to suspicious.email@kiwibank.co.nz then delete it.

- All scam types: Call us on 0800 113 355, or send us a secure message within internet banking or the mobile app.

Be alert

We'll never ask for your passwords, PINs, KeepSafe questions or card details by phone or email. If you're suspicious, stop the communication immediately and contact us on 0800 113 355.

Helpful resources

What to do if you've been scammed

Anyone can fall for a scam. If you suspect that you've been scammed, get in touch with us as soon as possible.

24/7 support

Fraud and scam support is available around the clock. Call 0800 113 355 or +64 4 473 1133 from overseas.

0800 113 355Protect yourself

Simple actions can significantly improve your online and financial security.

What you can do