Phone banking

Phone banking

Phone banking is an automated service you can use to check account information, transfer funds and make payments.

-

Check balances and/or recent transactions

-

Check credit card minimum payments and due date

-

Skip or change an automatic payment (fees may apply)

-

Transfer money between your accounts

-

Make bill payments to an existing biller

-

Order a statement.

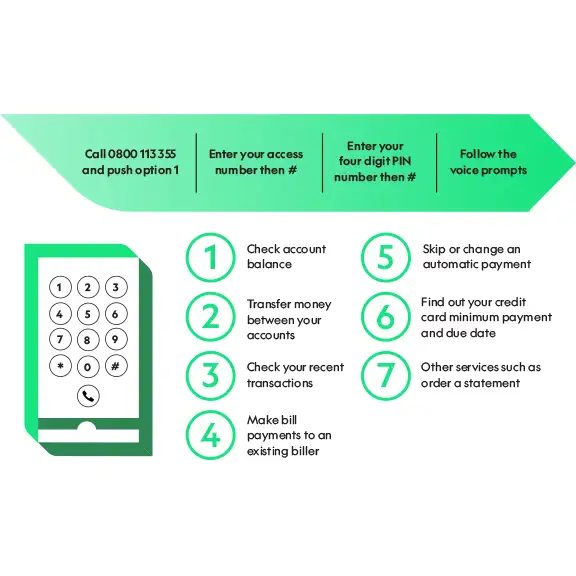

How to use phone banking

If you already have phone banking set up, follow the below step-by-step instructions. If you don't have it set up, call 0800 113 355, or from overseas +64 4 473 1133. Once you're set up, automated phone banking is free.

- Call 0800 113 355 and push option 1

- Enter your access number then #

- Enter your four digit PIN number then #

- Follow the voice prompts.

Self service options:

- Check account balance

- Transfer money between your accounts

- Check your recent transactions

- Make bill payments to an existing biller

- Skip or change an automatic payment

- Find out your credit card minimum payment and due date

- Other services such as order a statement.

Download our full phone banking guide to see all menu options available.

Frequently asked questions

Setting up phone banking

- Once you're set up, to use phone banking call 0800 113 355 and select option 1.

- To set up phone banking, call 0800 113 355 to talk to a customer experience representative, or from overseas +64 4 473 1133.

Once you're set up, automated phone banking is free.

Yes, you’ll need to set up phone banking to get started. To do this, call our contact centre on 0800 113 355 and talk to a customer experience representative. They’ll ask you a few questions and set you up. See contact centre opening hours.

The two ways to set up phone banking are by visiting one of our branches or by talking to a customer experience representative at our contact centre.

Phone banking is calling our automated virtual assistant who responds to dial pad responses on your phone. The virtual assistant will walk you through the process by reading out options and responding to options you select on your phone. Download our guide to the self service menu options you'll hear when you call phone banking.

Transferring funds

You’ll need the specific accounts you’d like to transfer funds between set up within phone banking to access them. If you need more accounts added, please speak to one of our customer experience representatives as they’ll be able to help.

There’s some limitations with what you can do in regards to credit cards. You can check credit card balances and see your last five transactions, however you can't make cash advances to your account.

This is likely because your savings account isn’t yet set up within phone banking. To get more accounts added to your phone banking, please call 0800 113 355 to talk to one of our customer experience representatives. Once set up, this option will be available within your phone banking the next time you ring.

Making payments

Yes, you can make bill payments within phone banking.

If you’ve got a payee saved within internet banking or the mobile app, you can have these available within phone banking by speaking to one of our customer experience representative to set this up.

If you’re wishing to pay someone that isn't already within your internet banking or mobile app saved payees, we'll need to verify your identity by confirming the details of the identity documents we have on file for you. This is usually you reading out your passport or drivers license number. To do this, please talk to one of our customer experience representatives on 0800 113 355.

This may be because you only have one account registered on your phone banking. To set up more, please call us on 0800 113 355 and ask to talk to a customer experience representative.

If you’ve got a payee saved within internet banking or the mobile app, you can have these available within phone banking by speaking to one of our customer experience representative to set this up.

If you’re wishing to pay someone that is not already within your internet banking or mobile app saved payees, we'll need to verify your identity by confirming the details of the identity documents we have on file for you. This is usually you reading out your passport or drivers license number. To do this, please talk to one of our customer experience representatives on 0800 113 355.

Text banking & alerts

Text banking

Text banking is a quick way to find out your balance from the palm of your hand. You can:

- Get balances for as many accounts as you like – except for credit cards and KiwiSaver

- Ask for the last five transactions you made on one of your accounts.

To set it up, log in to internet banking and go to ‘Settings’ and pick which accounts you’d like to get a text balance from. Once you’re set up, just text BAL to 5494 anytime and we’ll text you straight back for free. Your mobile provider may charge you for the text.

Alerts

You can choose to have us alert you by text or email (or both) when:

- Your account balance falls under a set limit

- You receive deposits over a certain amount

- A regular automatic payment can’t be paid – usually because there isn’t enough money in your account. This alert provides an opportunity to transfer some money before we try the payment again. You’ll also get this alert if a scheduled one-off payment fails

- A regular automatic payment or a scheduled one-off payment dishonours

- A direct debit fails because there isn’t enough money in your account.

Alerts are sent around 9am the day after the alert is triggered.

You can set it up under ‘Settings’ in internet banking. You can set up as many alerts on as many accounts as you like – they’re available on all accounts except credit cards and KiwiSaver.

Standard terms and conditions

Text banking and alerts aren't available on all accounts.