Public notices

Upcoming & recent changes for NZHL-arranged home loans

Home loans variable rate change — 23 February 2026

We’re making rate changes to our variable home loans.

These rate changes impact Term loan — variable and Reducing revolving home loans.

We're increasing our rates on the following home loans from:

- Monday 23 February 2026 for new loans

- Monday 9 March 2026 for existing loans.

| Empty header |

Previous rate |

New rate |

|---|---|---|

|

Term loan — variable* |

5.65% p.a. |

5.75% p.a. |

|

Reducing revolving* |

5.90% p.a. |

6.00% p.a. |

* For all bridging loans, the interest rate will be 1% p.a. above our NZHL variable rate or NZHL reducing revolving rate, as applicable.

Date effective: 23 February 2026

Date published: 23 February 2026

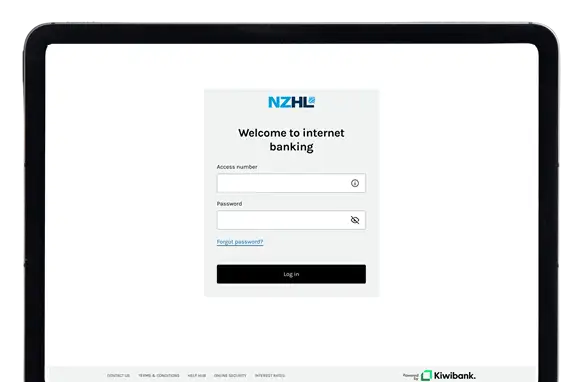

Changes to your internet banking login

- When you log in to internet banking, you'll see refreshed sign-in screens with a cleaner layout.

- How you log in hasn't changed — you'll still use your existing access number and password.

- During the rollout, you may notice the web address (URL) change when you log in to internet banking or move between different parts. This is expected and your banking remains secure.

- Genuine NZHL URLs always contain "nzhltransact.co.nz".

- We'll be rolling out these updates in phases to small groups of customers, so not everyone will see the updates straight away.

Find out more about our internet banking refresh.

Date effective: 28 January 2026

Date published: 22 January 2026

Previous public notices

For older public notices, see our public notices archive.

-

Go to NZHL Transact

Log in to internet banking

Visit nzhl.co.nz

-

Get the app

Download the NZHL Mobile Banking app:

-

Contact us

Call 0800 333 238 from within New Zealand

Call +64 4 382 1768 from overseas